Broad Group, Part II

Welcome to Construction Physics, a newsletter about the forces shaping the construction industry.

Last week we talked about Broad Sustainable Building’s original prefabricated building system, and their new panel product, B-Core. This week we’ll conclude with a look at how Broad is using B-Core as part of a new prefab building system, and their other construction subsidiary, which uses precast concrete panels.

Broad’s New Prefab Modules

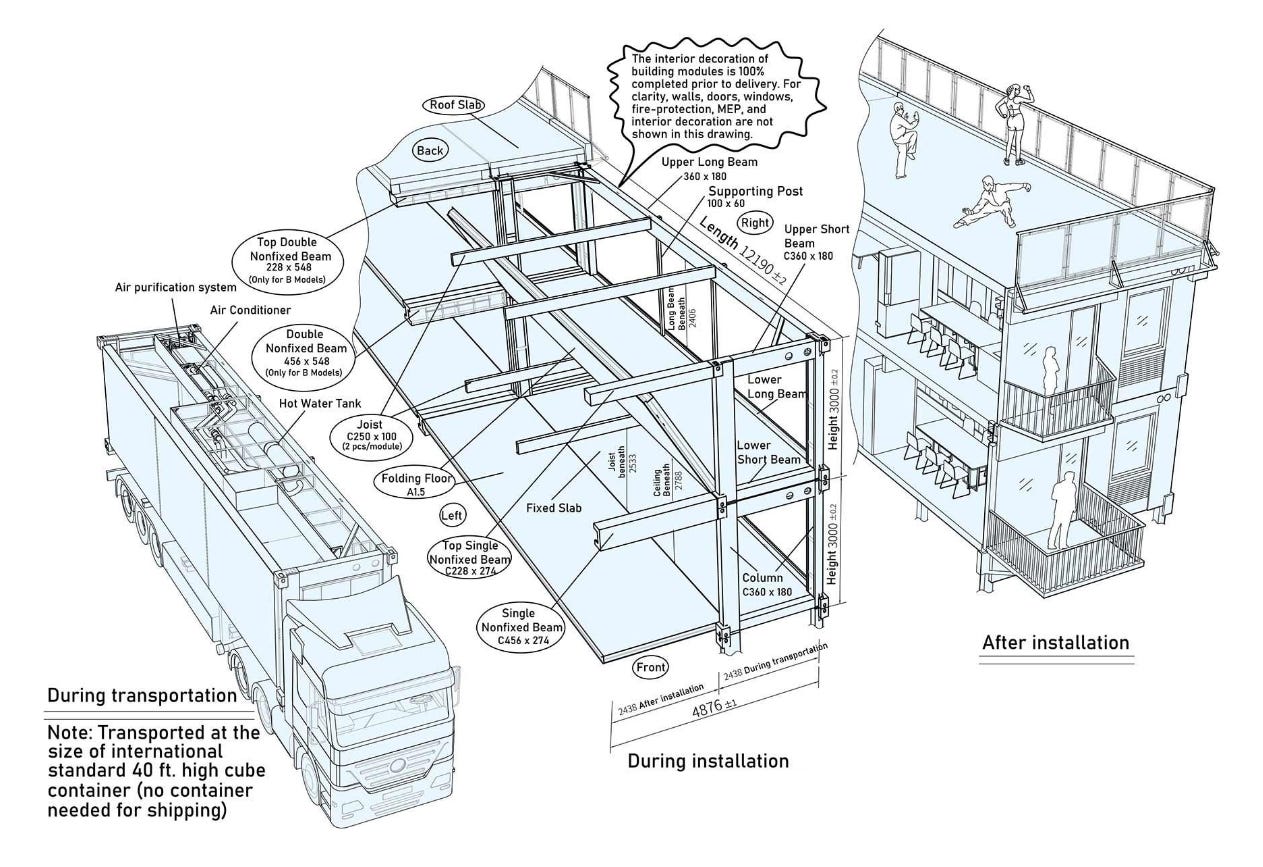

Broad has taken their B-Core panels and used them as part of a new volumetric modular building system. The modules are steel framed, shipping container sized boxes, that use B-Core for the floors, walls, and roof. Modules are built to a high level of factory completion - all services and finishes are factory installed, with the mechanical systems residing in the gap between the ceiling and the floor above. Modules are all the same size, but are built out in a few different types of rooms, allowing for a (limited) variety of building configurations.

Typical of Broad, installation is dead simple, and can be done extremely quickly. Modules are craned into place, supporting beams are bolted into position, and the floor is unfolded. The whole process is then repeated module by module until the building is complete. Broad even has an option to provide complete furnishings for the building, making it even more of a turnkey system.

The most noticeable feature of the modules is the folding floor, which folds up during transport and then folds down after installation, becoming the floor of the adjacent space. This lets modules be installed in a checkerboard pattern, with a gap between each module. This effectively doubles the amount of square footage being shipped. Folding window boxes give some additional square footage as well. This folding system is clever, and is a smart way to increase the amount of “building” that gets shipped per truck, in a way that probably isn’t adding a large cost overhead.

Another feature is that the high level of completion, combined with bolted assembly, means that buildings can be taken down and re-erected elsewhere. In practice, “permanent” buildings with this feature rarely use it - mobile homes for instance, rarely move off their lot once they’re installed. But it’s important if you want your building to be more like a product and less like a permanent feature of the landscape.

One very nice thing is that Broad is being incredibly open with their system. They’ve essentially provided a catalog, which gives:

floorplans for all their different building options

specifications,

performance criteria

deliverables and exclusions

and, incredibly:

a price list for both whole buildings and individual components.

In some ways this is the most impressive part of the whole offering, and moves it from “just another method of construction” to a truly productized building. With a product, you know exactly what the cost is, and what you’re getting, upfront. But the inherent uncertainty of the construction process means it’s very risky for builders to commit to a price for a building that hasn’t been built yet. So this is refreshing to see.

Being this upfront lets us see exactly how this system compares to more traditional construction.

The least expensive building per square meter is the largest, the B9-24 (a 24-story, 96-unit apartment), which has a base cost of $928 USD/m2, or just over $86/square foot [0]. But this excludes a few additional costs necessary to get a functional building:

sitework and foundations (tack on 15% or so)

installers fee (another 8%)

the small matter of transporting it from China ($0.75/ft2 per 100km by land, $0.15/ft2 per 100km by sea)

This brings us to around $115/square foot if you’re building in Shanghai (just over 1000km from Broad Town), and $130/square foot if you’re building in LA (~10,000 km from Shanghai).

This pricing is still pretty dang good (though I suspect those transportation fees are WILDLY optimistic [1]). But it’s still more expensive than “average” US construction costs, (though it would certainly give the folks in SF a run for their money). And these are the most optimistic possible numbers, from a company known for its boundless optimism. The volume of stainless steel in these buildings alone makes me question whether the pricing is realistic [2].

The marketing around this system is extremely strange. Broad has, among other things:

Created some sort of immersive videogame like program (I was not brave enough to download and run the executable, if anyone is I’d love to hear what’s in this).

Started an IndieGogo campaign to “make cities invincible” (raised a total of 210 dollars, just shy of their $5 million goal).

Written a series of novels and short stories, including one based on “Charlie and the Chocolate” factory, with the chocolate factory replaced with a prefab module factory.

Sponsored an artist-in-residence program on the Broad Manufacturing campus. B-Core is prominent on the program’s homepage, but it’s unclear if the art also has to be about B-Core.

Broad is taking preorders, and according to their website they can have a building delivered in 180 days, though as far as I’m aware they’ve only built test buildings on Broad’s campus, and two small COVID hospitals in South Korea. As of three months ago they were “verifying its structure before turning it into a product.” It’s unclear if any more buildings have been built with the system yet.

Overall, despite the use of B-Core and their weird marketing, I actually find this system fairly compelling. It’s arranged for long distance shipping intelligently, maximizing the amount square footage shipped in smart ways (folding) without adding a ton of extra complexity or field work. It doesn’t allow the layout to change for future use, but it is theoretically demountable and movable. It’s highly repetitive, making large-volume production easier - it actually resembles the “kit of parts'' idea, an endlessly alluring concept in building design where a relatively small number of basic components gets combined in a variety of building configurations. It also seems to be very close to realizing Da vid Wallance’s idealized system of shipping container-shaped standardized modules that could be mass produced and shipped anywhere in the world at minimum cost.

If they would move away from their flooring system (perhaps to something like what Z-Modular uses, thin panels of concrete sheathing over steel beams), there’s a lot to like.

Broad Homes

Broad Sustainable Building consumes almost all the media oxygen around Broad’s construction efforts. But there’s another, larger arm of the company, completely separate from Broad Sustainable Building. “Broad Homes” was founded in 2006 (3 years before BSB) by Zhang Jian, one of the cofounders of Broad Group.

Broad Homes is also uses prefabricated building components. Instead of steel framing or B-Core, they use precast concrete - concrete panels cast in a factory and then shipped to the jobsite. Broad Homes is the largest precast concrete manufacturer in China (13% of the market) as well as the largest manufacturer of precasting machinery.

You might expect the largest anything in China to translate to an enormous company. And you’d be right - Broad Homes has a LOT of precast plants. In China, they own 15 large factories, and have joint ownership of 85 more - and they’re adding more joint factories all the time [3]. I suspect this makes them the largest precast concrete manufacturer in the world.

Outside of China, Broad Homes has another 16 plants around the world, scattered all over - there’s some in South America, some in Africa, a few in Europe, etc. Some of these, like the Suriname plant, seem to be in the business of loading shipping containers full of precast and sending them to the surrounding area [4]. It’s unclear if Broad’s international factory presence is part of a larger belt-and-road initiative.

Despite the obvious synergies, Broad Homes and Broad Sustainable Building seem to operate almost completely independently. There’s no mention of Broad Homes in any of Broad Sustainable Building’s marketing literature [5], and BSB isn’t mentioned anywhere in any of Broad Homes’ financial reporting. According to Broad’s website, they share “operational and management resources”, though the management structures seem to be completely separate.

Broad Homes has a few different types of projects. One is large highrises made from panelized precast concrete. Another other is high end single family homes. Both of these are uncommon uses for precast in the US - we would typically do post-tensioned concrete or steel framed for highrises, and light framed wood for single family homes. But isn’t unheard of - quite a few US precasters will sell you a similar building. And precast concrete was popular to use for everything for a hot minute in the 60s.

Broad’s buildings consist of precast concrete panels that are attached together to make up the floor, walls, and roof of the building. In Broad’s case, they seem to favor a “semi precast” system - the panels, beams, and columns are produced with steel reinforcing sticking out, and gaps between the panels. These gaps will then be filled with wet concrete poured on-site, tying the whole structure together as one rigid element.

They also seem to have some sort of precast panel that’s a sort of kit-of-parts assembly - a few standardized components (wall panels, lintels) can be bolted together in a variety of ways to form single family homes. This seems to be their export product.

Like all precasters, Broad Homes locates their factories based on the maximum efficient transportation distance, which according to Broad is around 150km (just under 100 miles). This is perhaps 1/4th the efficient transportation distance for precast in the US - it’s unclear to me if this is a function of China’s transportation infrastructure, or the fact that China’s construction volume is so large that a 100 mile radius is more than enough potential market for a single plant (my money is on the latter).

Panelized precast concrete is a tried and true building system, one that’s been in widespread use for over 75 years. Broad’s precast plants seem fairly advanced (indoors, tilt tables, etc.), but not wildly different from what might be seen in a higher end US or European plant. Broad hasn’t reinvented any wheels, but it appears to have competently executed with it.

Broad expects the precast business to grow significantly - precast is the main method of building prefabrication in china (75% of prefabs), and their ministry of development has planned specifically to increase the floor area of building constructed via prefabrication.

Conclusions

Overall, aside from B-Core, which seems poorly thought out, I like the Broad modular building systems. I think they’re well designed, functional, and elegant (in sort of a utilitarian way).

Unfortunately, I suspect Broad won’t be the ones to change the construction industry. The original Broad Sustainable Building system seems to no longer be in production, and the new one, while it has a lot of attractive features, likely can’t beat conventional construction even with it’s wildly optimistic pricing (though there’s the argument to be made that it’s demountability still makes it a compelling offering).

Meanwhile, Broad Homes, using a much more conventional system, has quietly built an enormous, globe-spanning construction company. Where Broad Sustainable Building has built less than 40 buildings using its various systems, Broad Homes has built thousands [6]. Where Broad Sustainable Building hasn’t yet been profitable in any of it’s ventures, Broad Homes has a profit margin of over 30% [7].

Overall, Broad seems to be bad news for prefab optimists. Despite the tailwinds (huge construction market size, high degree of manufacturing expertise, higher density than the US making mass production easier), it mostly seems like China is constrained by the same forces that limit prefabrication everywhere else in the world.

[0] - At first I thought this would be wildly expensive for China, but it seems like the Chinese manufacturing cost discount has largely evaporated [link]. Tesla Model 3s, for instance, are roughly the same price in China as they are in the US.

[1] - For an idea of how optimistic - a US precast concrete manufacturer is spending millions building another plant just a few hundred miles away to reduce transportation costs.

[2] - Though another take would be that these costs are likely to drop significantly once mass production is underway - other than the B-Core, modules seem mostly manually assembled currently.

[3] - By comparison, I don’t know of a single US precaster that has more than 20 plants, and many of those will be fairly small operations

[4] - This is a little less surprising for Suriname, which exports to Carribean islands which are often too small to support a precast plant, and may need a highly hurricane-resistant home. It still seems wildly expensive though.

[5] - Probably wise on Broad Sustainable Building’s part - much of their supposed value proposition and marketing is based on high efficiency, being better for the environment, and eliminating concrete, so it’s sensible to omit that their sister company is an enormous producer of concrete.

[6] - That’s partially a function of the size of the Chinese construction market - precast concrete is around 5% of new construction in China, similar to the rate in the US.

[7] - To the extent that you can trust their financial figures.

Feel free to contact me!

email: briancpotter@gmail.com

LinkedIn: https://www.linkedin.com/in/brian-potter-6a082150/

Contato para obter a Representação no Brasil, da Tecnologia e da aplicação da mesma em obras no Brasil