The most common method (or at least the most central example) of construction project delivery is what’s known as “Design Bid Build”. Under this method, the customer hires two separate entities - the design team (usually led by an architect) who designs the building, and the contractor, who does the actual building. Once the design process is done, the architect serves in a supervisory role in the project, ensuring that what gets built matches their intent and the intent of the owner [0].

From a consumer point of view this method of purchase seems unusual (you don’t have to go to two different places to buy a car, or a computer, or any other consumer good), but separating design and manufacturing is fairly common practice at steps farther back in the value chain - you might buy your Ryzen directly from AMD, but AMD does the design and outsources the fabrication to TSMC. Same with the iPhone, which is designed by Apple but made by Foxconn, or the BMW X3, which is designed by BMW but made by Magna-Steyer.

But other instances of separating design from fabrication usually have the logic of mass-production behind them - it’s cheaper and easier to hand off a design to an already scaled-up factory that can amortize its fixed costs over many different customers, rather than trying to build a factory yourself. It doesn’t seem like the same logic would apply to construction, which has fewer fixed costs and mostly builds things one at a time. So it’s worth looking at how Design Bid Build became the standard, why it persists, and when we see a shift to other project delivery methods.

Architects, Owners, and Professions

Architects had been designing buildings in the US since the late 1700s, and architecture became established as a profession around the mid 1800s (the AIA was first founded in 1857). In the early days of the profession, the architect would generally be responsible for all aspects of construction, and for managing the contracts for each individual trade. As buildings got more complex and expensive to build, general contractors began to appear that would be contracted to build the entire building, then hire the required trades or perform the work themselves. The role of the architect shifted from managing the construction project to being the owner’s agent - ensuring the construction was completed appropriately. By the late 1880s, this system was firmly in place - from a speech from the first convention of the National association of builders:

The architect is the agent of the owner. The courts have so decided. He is paid by him, and only by him if he is an honest man. An architect’s certificate is as good in law as a bill of exchange, a draft or a promissory note. He is, therefore, doing his duty when he is looking after the owner’s interests. The contractor is doing his duty to himself by looking after his own Interests.

The architect taking the role as owner’s representative, and being separate from the actual task of construction, makes sense from a principal agent perspective. The one-off nature of most building projects makes construction much more like a service industry than a manufacturing industry. When buying services, the customer faces the problem of verifying that the service is being performed correctly - the very thing causing you to hire someone (them having expertise that you lack) also prevents you from being able to evaluate whether they’ve actually done what’s needed (or have done MORE than what’s needed). Services are often opaque to non-experts, which is why people are always worried that their mechanic is ripping them off, and why there are so many plumbers with “honest” in the business name.

The idea of a “profession” is essentially a solution to this - professions typically have formal qualifications (to ensure a minimum level of competency) and usually some code of ethics or rules that require them to uphold professional standards. These professional standards often hold the force of law - breaking them can mean being stripped of your qualification and unable to practice.

These professional standards are a solution to a coordination problem - architects, engineers, doctors, and lawyers all benefit if people trust them to provide reliable service, but any individual might be incentivized to “defect” - to collect payment but shirk on the service, or to dramatically inflate what services are required. Coupling a strictly enforced code of conduct with the qualification required to practice helps solve that problem.

Construction isn’t immune from this problem of service opaqueness - it’s not trivial for the owner to evaluate whether the building they purchased meets the relevant building codes, or whether the materials the contractor decides to use will meet the performance requirements. And once the walls are up and the paint is on, diagnosing building problems becomes difficult even for experts (which is why home inspectors include so many caveats and CYA phrases in their reports). Many errors, such as incorrectly installed waterproofing, might accumulate damage very slowly and not be visible for many years. Others, such as insufficiently strong balcony connections, might only show up in conditions of extreme loading that don’t occur often.

Thus architecture became a profession whose ethical guidelines include upholding the owner’s interest, and verifying that construction has been performed properly. The architect acting as the owner’s agent gives the owner a way of monitoring that the service is being performed correctly - the architect is both an expert, and (theoretically) unbiased, since their incentive is for the building to get built properly (architects are typically paid a fixed fee, and thus don’t stand to gain from a less expensive but lower quality building). Integrating design and construction, or having the architect employed by the contractor, theoretically presents a conflict of interest - the AIA’s code of conduct actually specifically forbade this until the 1970s [1].

Construction and Vertical Integration

More broadly, the sort of industry structure where designers and contractors can be separate, specialized firms with relatively weak relationships has to do with the trajectory of building technology, and the demands of customers at various stages in the value chain.

Clay Christensen lays out this basic dynamic in “Disruption, Disintegration and the Dissipation of Differentiability”. Roughly, when the customer wants more out of a product than it’s capable of delivering, you tend to see highly vertically integrated industries. Delivering the ever-increasing performance that customers are asking for requires combining components in non-standard ways, creating or modifying new parts that get past performance bottlenecks, and tightly coupling various parts to take maximum advantage of their capabilities. For instance, during the development of the Blackbird, Lockheed engineers had to invent many manufacturing techniques for working with titanium, the only suitable airframe material that could meet their performance requirements. A more recent example is Tesla, which is working on it’s own battery manufacturing to bring down cost and increase performance.

This sort of performance engineering results in highly interdependent product architectures, with many components coupled tightly together. These sorts of product architectures require a high degree of design coordination that is most easily delivered by highly integrated firms which can minimize coordination costs.

However, over time technology improves, and eventually surpasses what most customers need the product for - most folks don’t need a car capable of going 253 miles per hour, and aren’t willing to pay for one. Once product performance is “good enough” for most customers, it’s no longer necessary to push the limits of engineering design with a tightly coupled architecture. When this happens, firms stop competing on product performance (since most customers don’t care about maximum performance), and start competing by being fast to market with products tailored to some specific customer need or group. This sort of competition is made easier with a standardized, modular product architecture. Products based on standard, off-the-shelf components can be developed faster (since you’re just combining already existing components), and can flexibility adapt to a customer’s needs (since you can arrange different standard components in a variety of ways depending on the requirements).

You see this dynamic in the PC industry in the early 90s. Computer performance improved faster than customers were able to take advantage of the new functionality, and the lion’s share of the market shifted from highly integrated, customized computers, to assemblies of off the shelf, standardized components produced by companies like Dell, Compaq, and Gateway.

Building construction is squarely at the “modular” end of this technology spectrum.

Constructing a building can be thought of bringing a product to market (planning requires analyzing local demand, how competitive the market is, what features customers want, etc.) [2]. Most customers purchasing a building don’t require an ultra high-performance building that pushes performance to the limit, they just want to get their building built quickly with the exact features that they want. And this is what the construction industry delivers. Buildings are mostly assembled using standard, off-the-shelf components combined in well-defined ways. And in addition to the components, building construction services are modular as well. A building is broken up into many discrete trades and systems (framing, mechanical, plumbing, fire protection, etc.) and the designers and builders of those systems generally win work by being the low-bidder. Designers and contractors are, in a sense, modular and interchangeable - the lack of tight integration between firms means it’s easy to swap them in and out (developers in fact often have basic building “templates” they use, which will be finalized and built by a variety of different architects, engineers, and contractors).

Modularity, Vertical Integration, and Profits

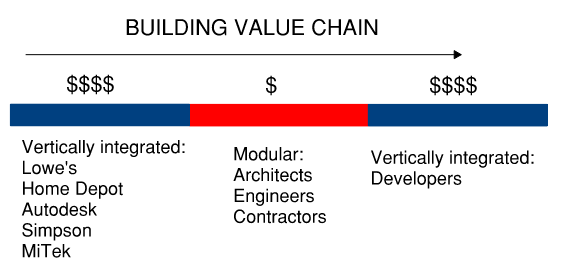

When you see this sort of modularity in an industry, you tend to see highly integrated firms pop up at adjacent spots in the value chain.

The PC industry again provides an example - the highly modular PCs of the 1990s were sandwiched between Intel offering a proprietary, optimized chip architecture on one side, and Microsoft’s proprietary, integrated operating system on the other.

In the construction industry you see the same dynamic - in the middle, you have modular and interchangeable design consultants and contractors. On one side you have highly integrated building material suppliers and component fabricators like Simpson (wood fasteners, ties and hangers), MiTek (trusses, joist hangers), Weyerhauser (engineered lumber products) and even Home Depot and Lowes. On the other side, you have integrated developers which combine land acquisition, site planning, market research, marketing, and project financing - integrating all the product development aspects.

Interestingly, on the other side of the developer, you get a sort of modularity again - an individual building can swap out its functionality via appliances that connect through a standard interface (electrical outlets), or by changing the furniture, or by moving internal partitions around.

In this sort of industry structure, profits tend to accrue to the more vertically integrated portions of the value chain. They’re able to achieve returns to scale, while modular, interchangeable parts get commoditized and ground down by relentless competition. We see this in construction - architects and engineers tend to earn low single-digit profit margins (AECOM has just over 5% gross margins; Arup has a profit of just under 8%), as do contractors (Kiewit has around 5% profit margins, Skanska’s gross margins tend to sit at a bit under 10%).

Vertically integrated building material suppliers, on the other hand, do much better: Weyerhauser earns around 20-25% gross margin depending on the year; Home Depot has over 30% gross margins. And Simpson is at over 45% gross margin.

Developers also do much better - large builders like Lennar Homes and Pulte earn over 20% gross margins; Prologis, a developer and manager of industrial real estate like distribution centers, earns over 70% gross margins and 30% net margins.

You can imagine a new player trying to integrate the modular portion of the industry (ie: the actual construction) by using new technology or by achieving returns to scale that results in a better, cheaper product. In this version of the value chain, it’s the building material suppliers and developers that get commoditized: the large, vertically integrated builder can squeeze suppliers, much like Amazon or Walmart does. And it can offer a turn-key product that lowers the barrier to entry for developers, fostering competition between them. This is essentially what Katerra tried to do:

Katerra was often criticized for leaving money on the table by not taking on the developer role; this perhaps sheds some light on why they didn’t. Why bother taking on the labor intensive, difficult-to-scale part of the industry if you can force someone else to do it while sucking up all their profit?

Design Bid Build vs Design Build

Of course, Design Bid Build isn’t the only kind of project delivery method. Another common method of project delivery is Design Build. Under Design Build, instead of two contracts, the owner has a single contract with a firm that handles both the design and the construction (sometimes the firm is a highly vertically integrated design-builder, sometimes it’s a sort of contractual shell that uses the same contractors and designers that might typically be on a design-bid-build project).

Design Build has many strengths - the single contract is simpler, and can shield the owner from some of the risk during construction. Close integration between the designer and the builder can help resolve coordination problems, reduce errors, and speed up construction time. So where do we see this method used?

The previous dynamic suggests we should see more integrated construction as buildings get more complex. Complex buildings tend to have customers that care more about performance (since the complexity arises from the extra features and systems that the customer wants). And as building complexity increases, the costs of verifying construction has been done correctly rise SLOWER than the potential savings from coordinating - the costs of verifying rise linearly with the number of building elements, whereas the savings from coordinating rise with the square of number of building elements (since each new element needs to be coordinated with every existing element). So as buildings get more complex, the benefits of having the architect as the owner’s agent actually go down - the benefits of designers and builders closely collaborating outweigh the savings from not needing to do your own verification (or hire a third party).

And in fact, this is what we see - larger, more complex projects make much higher use of design build:

The larger and more complex your project gets, the more common it is to see design build as a delivery method. On the other hand, the simpler your building is, the more you see commodified, interchangeable builders and contractors. Typical residential construction, which uses time-tested materials and methods, is largely characterized by this. The sorts of residential construction where high-end performance is required, such as with high-end environmental and energy performance, tends to see more vertically integrated builders such as Bensonwood, New Frameworks, or Plant Prefab.

Conclusion

So, to sum up:

Much of construction is delivered via design-bid-build, where design and construction are handled by separate firms

The specific arrangement of the architect being separate from the builder is due to the architect’s status as the owners agent, and is a way for the owner to verify the construction services are being performed correctly.

More generally, the separation of design and construction reflects an industry not driven by high-performing products developed by vertically integrated, but one flexible products built using “modular” components and services. Design and construction are more integrated in areas where building performance is more important, such as large complex projects or with high performing green builders.

“Modular” parts of the industry tend to operate with low profit margins, and tend to be adjacent to higher profit, more vertically integrated parts of the value chain, such as large building product suppliers or large property developers.

[0] - As always, it’s often more complicated than this - for instance, sometimes the contractor and customer are the same person (such as developers that do their own general contracting).

[1] - This rule was also likely an attempt to avoid being commoditized by builders.

[2] - Building construction may seem slow, but viewed through the lens of product development, it comes off much better: very few products are brought to market as fast as a building can be planned, designed, and built.

Feel free to contact me!

email: briancpotter@gmail.com

linkedin: https://www.linkedin.com/in/brian-potter-6a082150/

This is a high quality blog you have. As someone coming from an economics background and having zero construction/engineering exposure this is great. I'd be interested to read your take on Japanese construction. I follow some Youtubers who are building there now and it seems Katerra adjacent.

Design Build is on a spectrum, you don't have total control, but you can still specify things that are important to you (i.e. x number of rooms, y sf, z floors, a floor tiles, b wallpaper, c appliances, you can even provide a floor plan).

Great article Brian. Would love to see one on contract types: which one is the worst and why is it GMP?