Reading List 02/21/26

Welcome to the reading list, a weekly roundup of news and links related to buildings, infrastructure, and industrial technology. Roughly 2/3rds of the reading list is paywalled, so for full access become a paid subscriber.

Housing

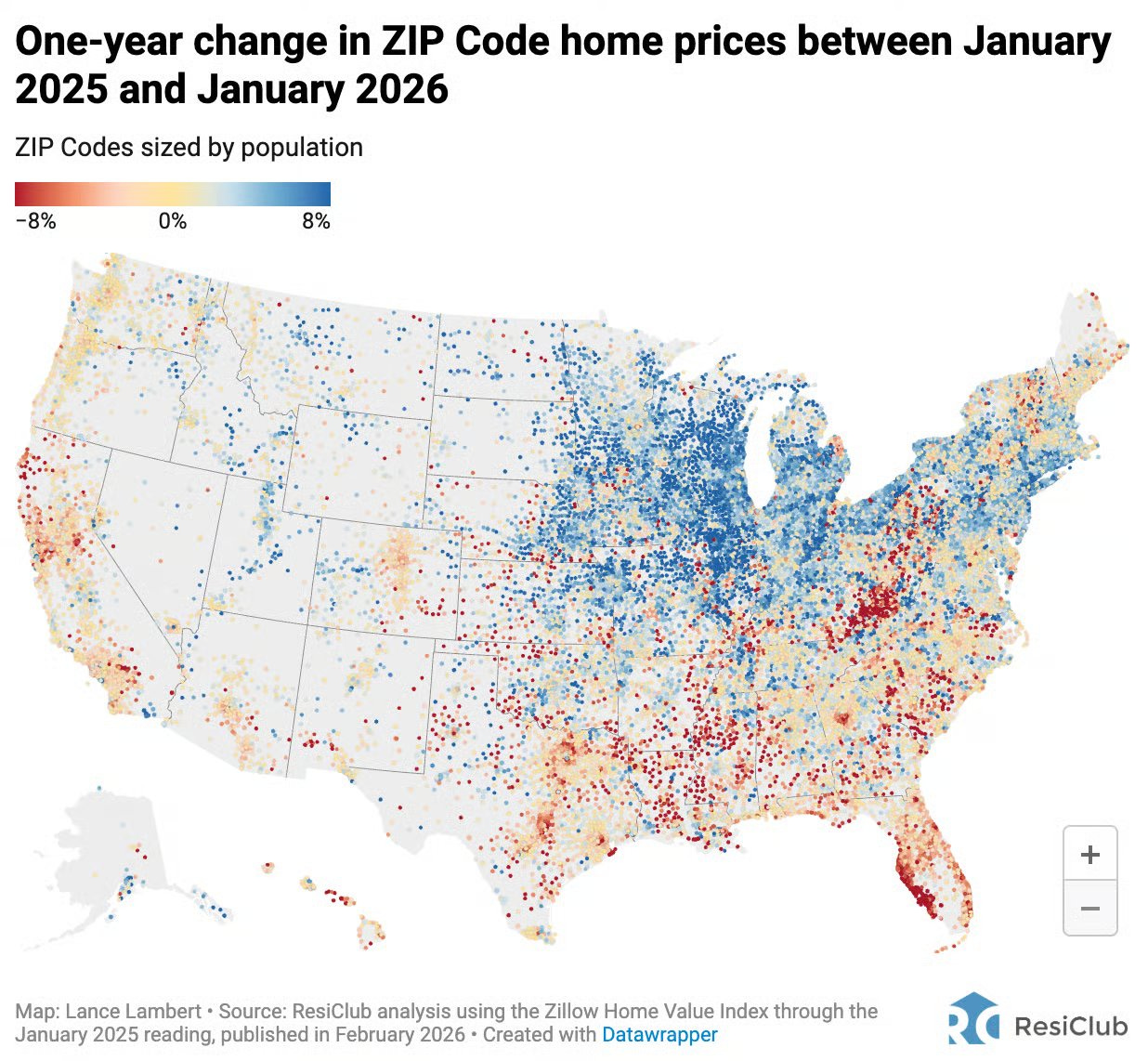

A map of how home prices have shifted in the last year. Prices in the midwest and parts of the northeast are up, prices in the south are down. [X]

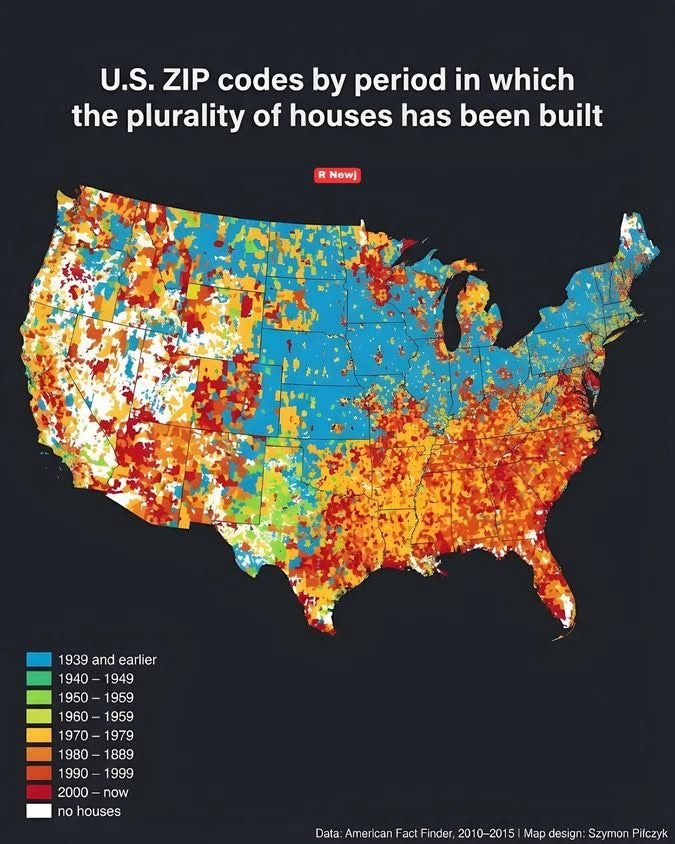

Interestingly, this map lines up really well with this map of what time period the largest fraction of homes in a given area were built in. In the midwest and northeast, for most areas the largest fraction were built prior to 1939. In the south, for most areas it’s post-2000. [X]

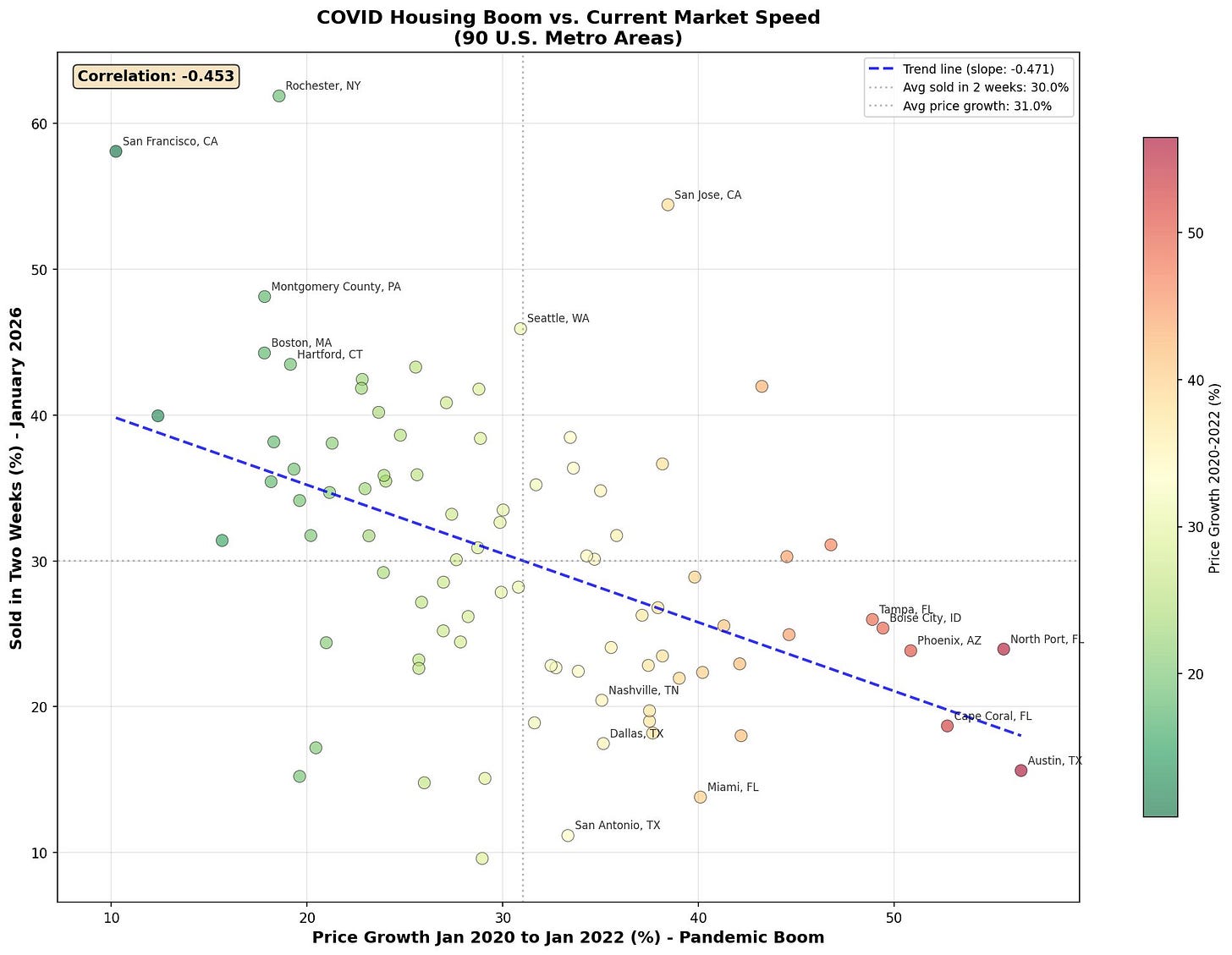

Also, the places with the biggest COVID housing price booms are now the places where it’s the hardest to sell your house. [X]

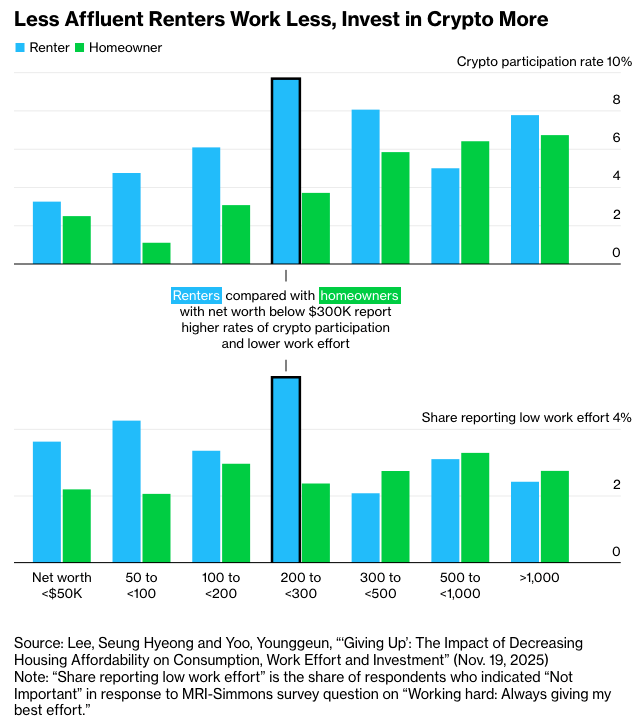

Bloomberg has a piece looking at different decisions made by homeowners, renters who expect to buy a home someday, and renters who expect never to own a home. One interesting datapoint: for low-income brackets, renters have a higher propensity to invest in crypto, and a higher rate of reporting that they put in low effort at work. [Bloomberg]

Related, in an essay about California’s pivot to anti-growth in the 1960s, I noted how Prop 13, which cut property taxes and locked in extremely low tax rates, cemented the opposition to growth that had been rising since the 1960s, and that there were similar “tax revolts” in states across the country. Now it seems like opposition to property tax is gaining traction again: Florida’s house of representatives just passed a bill that would remove non-school property taxes for all “homesteaded properties” (which, as I understand it, basically means primary residences). [Florida Phoenix]

Manufacturing

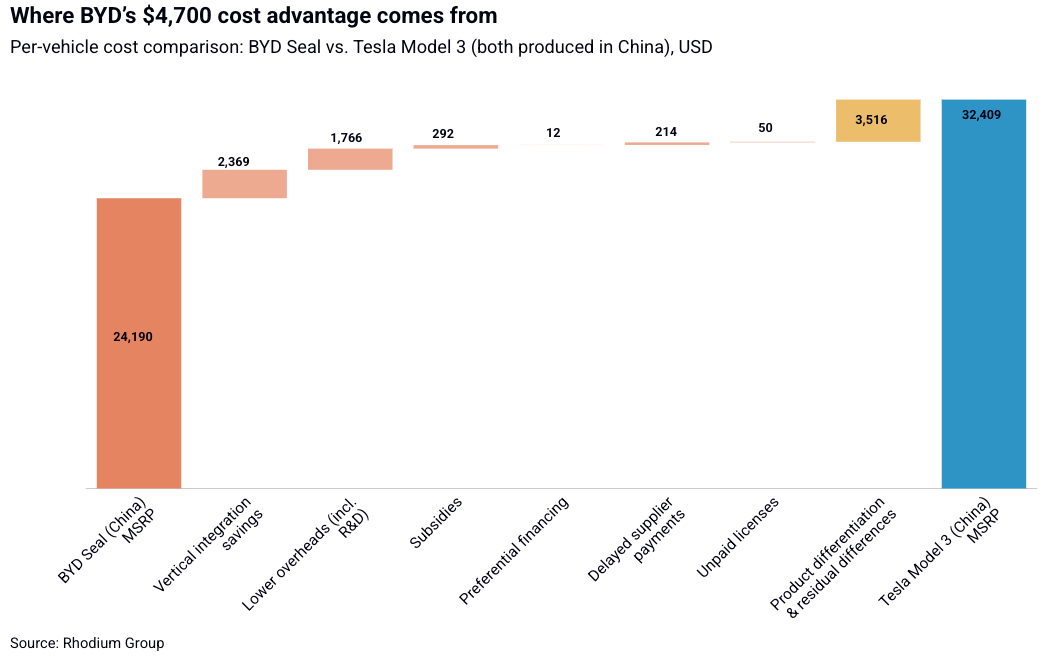

The Rhodium Group has a good article breaking down why Chinese EVs are so cheap. It doesn’t seem to be about labor productivity (which is lower than Western firms), or subsidies. Instead, the advantage mostly comes from the level of vertical integration they’re operating at. “For BYD, vertical integration is the single most important factor behind the company’s price advantage. That said, even among Chinese OEMs, BYD and Leapmotor are outliers. This helps explain why BYD has been among the companies most consistently leading price decreases over 2024 and 2025. Vertical integration requires higher upfront capex and R&D, but it eliminates supplier markups across a much larger share of the vehicle.” [RHG]

Discussions between Ford and the Trump administration about setting up Chinese car plants in the US via joint ventures. This idea keeps coming up. [Bloomberg]

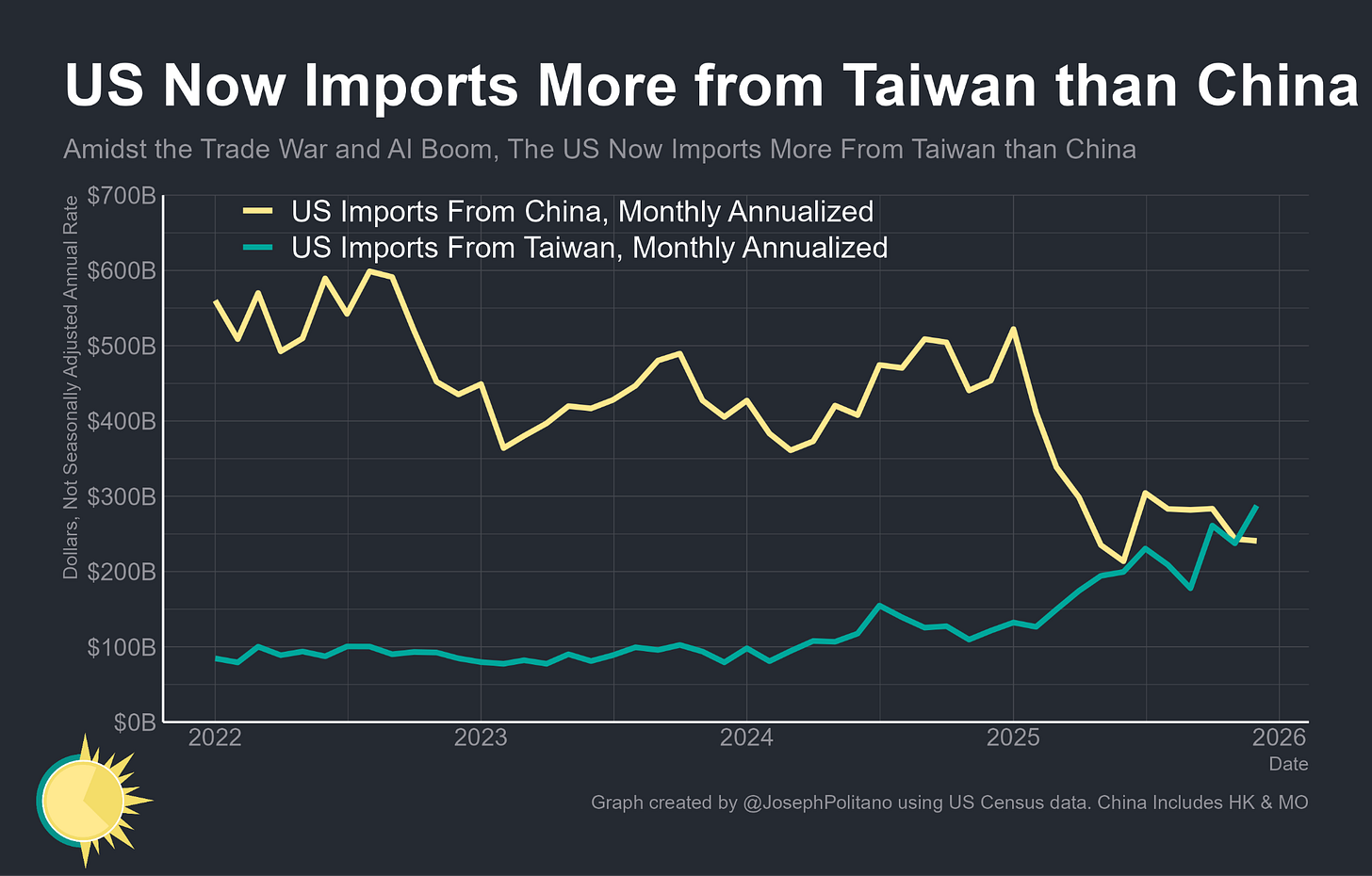

Thanks to the trade war with China, and the huge amount of chips and other electronics the US is importing from Taiwan for data center construction, the US now imports more from Taiwan than it does from China. [X]

Similarly, thanks to the huge demand for memory chips from AI data centers, computer memory manufacturer Micron is spending billions of dollars on new memory fabs in the US. “In Boise, where the company is based, Micron is spending $50 billion to more than double the size of its 450-acre campus, including the construction of two new chip factories, or fabs…That’s not all. Near Syracuse, Micron just broke ground on a $100 billion fab complex that represents the state of New York’s largest-ever private investment.” [Wall Street Journal]

Likewise, TSMC is planning to spend $100B on four more Arizona fabs. [Tech Powerup]

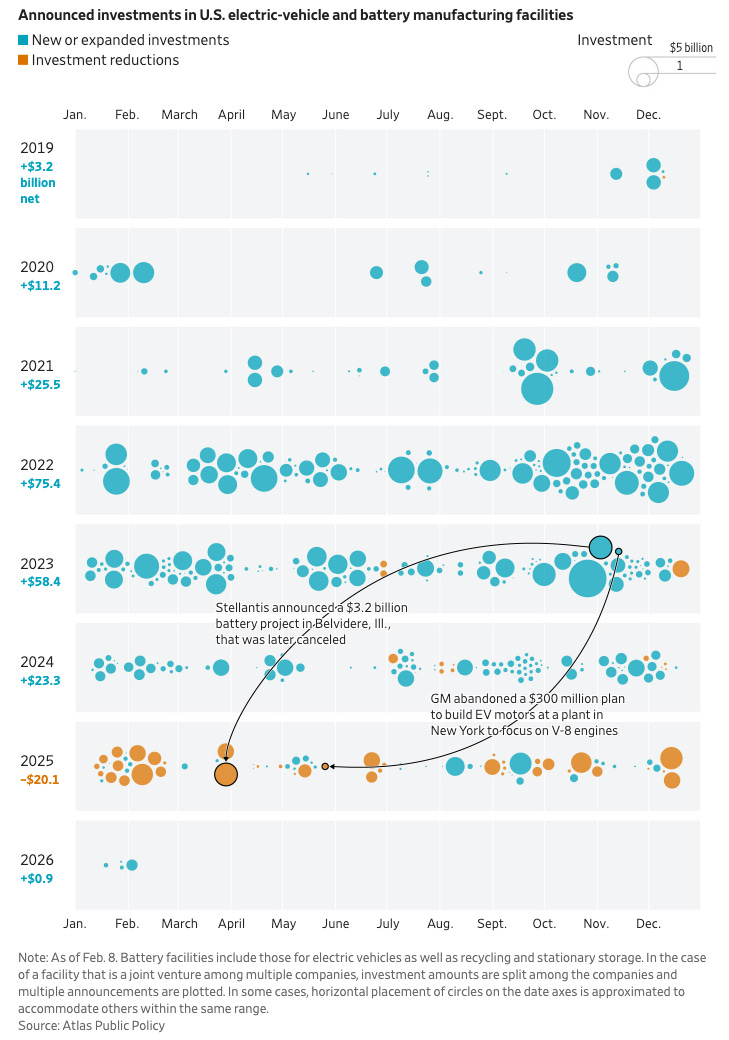

The WSJ on the EV writedowns of the US auto manufacturers. “More than $20 billion in previously announced investments in EV and battery facilities were wiped out last year, according to Atlas Public Policy, which tracks clean-economy investments. That drove the first net annual decrease in announced investments in years.” [Wall Street Journal] Related, car manufacturer Stellantis sells its stake in a Canadian battery manufacturing plant for $100. [Detroit News]

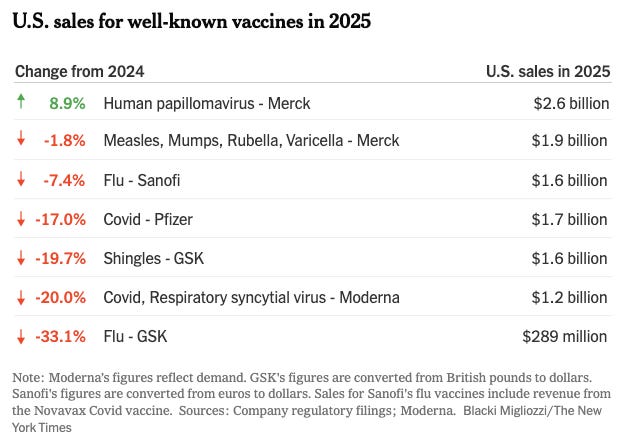

US vaccine manufacturers are struggling: thanks to RFK’s anti-vaccine efforts at the Department of Health and Human Services, vaccine sales are down, jobs are getting cut, and investments in new vaccines are being scaled back. And it seems like things might get even worse for them. “A major concern for the big companies is whether the Trump administration will do away with the special liability protections afforded to vaccine makers that have helped them stay in the market.” [NYT]