Why Did We Wait so Long for Wind Power? Part III: Offshore Wind

Historically, most wind power has been built on land. But we're increasingly seeing turbines be built offshore, in the ocean.

There are a few reasons you might want to build a wind turbine offshore. For one, winds over the ocean typically blow faster, and steadier, than winds over the land. And while wind over land often blows most strongly at night (when it’s needed the least), offshore winds often blow most strongly in the afternoon and early evening, when it’s needed the most. Together, this means that offshore wind turbines operate at higher capacity factors than onshore turbines.

Offshore wind resources often exist in places that don't necessarily have other significant renewable resources. The northeastern US, for instance, has comparatively few solar and onshore wind resources, but very significant offshore wind resources. Even in places with significant onshore wind resources, as the best locations with the strongest winds get built out, offshore locations will look increasingly attractive.

Offshore wind resources also often exist closer to population centers, meaning less transmission infrastructure is required to deliver their energy.

An onshore turbine must have its components delivered over the road, which limits how large they can be. Without a significant change in how they’re constructed, current onshore turbines are likely near their maximum size (~5-7 MW). Since offshore turbines don’t need to be transported over roads, they can be built much larger — current offshore turbines are up to 14 MW in capacity, and larger ones are planned. Wind energy costs have fallen in large part due to geometric scaling effects from making the turbines larger, and offshore turbines have a clearer path for this to continue than onshore turbines.

But there are also significant drawbacks for trying to build wind turbines offshore. The most obvious is that installing turbines in the ocean is expensive, more expensive than installing them on land. Most offshore turbines are currently fixed-base turbines, which get attached to the sea floor (there are a variety of methods for this, but the most common is driving a monopile foundation into the sea floor). Not only is this expensive, but it requires different expertise than constructing turbines on land. Transmission cables and other infrastructure that the turbines require must likewise be installed underwater. Installation is often delayed by poor weather conditions.

In addition to increased installation costs, offshore turbines are more expensive to maintain. The corrosive effects of seawater, impacts from waves, erosion from the impact of raindrops, ice, and salt, the higher wind speeds, and the more severe weather all mean that offshore turbines experience more wear and tear than onshore turbines. And because of their location, servicing them is more difficult. Technicians must be brought using boats or helicopters, and major turbine maintenance requires using an expensive jack-up rig.

Offshore development has thus far been in relatively shallow waters (less than 60 meters deep). But most offshore wind resources are in deeper waters. Building turbines in deeper waters means using turbines that float on the surface instead of being mounted to the sea floor. Floating offshore wind technology is in its infancy, with only 123 MW capacity currently deployed, but there are currently over 60,000 MW of floating offshore wind projects in various stages of development worldwide.

Development of offshore wind

Because of these difficulties, offshore wind is more expensive than onshore wind, and it's been slower to develop. The first offshore wind farm was built off the coast of Denmark in 1991, but as of 2000 there was only 36 MW of offshore wind capacity installed worldwide, compared to over 15,000 MW of onshore wind. As of 2021 offshore wind capacity had increased to over 50,000 MW, but this is still dwarfed by the 774,000 MW of worldwide onshore capacity.

As of 2021, offshore wind was roughly twice as expensive as onshore wind. Partly this is due to the fact that offshore wind is higher up the learning curve — onshore wind has had more time and experience, and has accumulated more efficiency-increasing improvements than offshore wind. But even when comparing offshore to onshore at a similar stage of development, offshore still appears more expensive than onshore — when onshore installations hit 50,000 MW, the LCOE in the US was approximately $60-70 per MWh (and likely cheaper elsewhere), compared to $83 per MWh currently, per Lazard. It's unclear if offshore wind will ever be as cheap as onshore — even the most optimistic projections documented by the NREL have offshore wind more expensive than the current price of onshore in 2035 (though past projections have underestimated the future cost reductions of wind turbines).

Offshore wind development is concentrated in a relatively small number of countries. Just 3 (China, the UK, and Germany) make up more than 80% of worldwide offshore wind power capacity, and 6 (adding the Netherlands, Denmark, and Belgium) make up over 95%. By comparison, for total wind power the top 3 countries (China, the US, and Germany) make up 64% of capacity, and the top 6 (adding India, Spain, and the UK) make up 75%. The UK in particular builds a (proportionally) large amount of offshore wind — of the UK’s 26,812 MW of installed wind capacity, 12,739 of it (almost 50%) is in offshore farms.

This trend seems like it will continue — the UK, the Netherlands, and Denmark are all expected to install more offshore wind power than onshore over the next 4 years, though Germany and France are also expected to install significant amounts.

The US and offshore wind

The US builds a lot of onshore wind turbines — it’s second in total installed wind power capacity after China. But it’s comparatively far behind in offshore wind development, with just 42 MW currently installed (or 0.08% of the world's total).

Partly this is due to the fact that the US has a lot of comparatively easy to develop onshore wind resources. The US is fourth in the world in wind power potential (behind Russia, Canada and Australia), and 84% of its potential 84,000 TWh of wind power is onshore. But partly it's because the US makes it very difficult to build offshore wind farms.

This is caused by a variety of factors.

One is permitting and jurisdictional issues. The Outer Continental Shelf Lands Act gives the federal government jurisdiction over the area from 3 miles offshore out to 200 miles, at the edge of the US’s exclusive economic zone. Most offshore wind development will thus fall under federal jurisdiction (the average distance from shore for offshore wind installations is about 27 miles and getting larger). Offshore wind permitting is handled by the Bureau of Ocean Energy Management (BOEM), part of the Department of the Interior.

The permitting process for offshore wind is involved, and can trigger, among other things, numerous NEPA reviews. First, the BOEM identifies areas that might be suitable to designate for offshore wind development, a process which includes a NEPA review (though most so far have been Environmental Assessments with findings of no significant impact). This process is time-consuming — the BOEM is currently developing 7 areas around the US coast for leasing, the last of which (off the coast of Maine) won’t be ready for auction until the end of 2024.

Once the BOEM has found a candidate site, it auctions off the rights to develop offshore wind in that area. The lease winner creates a construction and operations plan (COP) for their proposed wind farm. This is submitted to the BOEM, who then reviews and performs another NEPA review, typically an EIS. Once the COP is approved, construction can start. Altogether, it can take up to 10 years of planning before construction can start on an offshore wind farm.

Note that several versions of this graphic have a 1 year completion time for the post COP-submittal environmental review portion. It’s not clear what this is based on, and seems at odds with actual BOEM timelines — even 2 years seems optimistic. For instance, the South Fork Wind Farm (one of two offshore wind farms under construction in the US) submitted its COP in June of 2018, and it was approved after the EIS was completed in January of 2022. This EIS completion timeline is typical for the BOEM.

The BOEM may also perform other NEPA reviews — for instance, after auctioning several lease areas in the New York Bight wind area, the BOEM is preparing a programmatic EIS for evaluating their impacts (which, theoretically, will make the subsequent site-specific EISs go faster). BOEM also delayed the licensing of the now under-construction Vineyard wind project to perform a supplemental EIS that looked at the potential cumulative impacts from subsequent offshore wind projects. Because offshore wind is a comparatively new industry in the US, and because NEPA relies on court cases as a guidepost for what’s required for an environmental analysis, it’s likely that NEPA analyses will be conservative (and thus extensive and time-consuming) until what’s needed is better understood.

Efforts have been made to streamline this permitting process. For instance, in 2018 the BOEM adopted a project design envelope (PDE) approach, which allows developers to submit a range of potential project designs in their COP (giving them more flexibility in developing the site). In 2021 it partnered with the Corps of Engineers to more quickly perform environmental reviews, and in 2022 it clarified its criteria for what counts as a “reasonable range of alternatives,” (note that all this streamlining is largely to try to make the NEPA process simpler and faster). But it’s still a many-year process before construction can even start on an offshore wind farm in the US.

Beyond the BOEM’s permitting process, there are many other regulatory coordination issues that must be navigated. The Center for American Progress lists a total of 26(!) federal agencies that have jurisdiction over ocean resources and activities:

This makes for a challenging regulatory environment. Some of this complexity around regulations is described by the Center for American Progress’s report “The Road to 30 Gigawatts”:

The regulatory framework for offshore wind in the United States is governed by federal, state, and local governments. At the federal level, the U.S. Bureau of Ocean Energy Management (BOEM) is responsible for offshore wind development, including lease sales, easements, rights of way in federal waters, and coordinated permitting activity.16 The U.S. Bureau of Safety and Environmental Enforcement (BSEE) is responsible for offshore wind safety, environmental enforcement, and compliance functions. The Federal Energy Regulatory Commission (FERC) is responsible for interstate wholesale sales of electricity and for electric transmission.17 Various other agencies have authority with respect to different permitting aspects of projects.18 For example, the National Oceanic and Atmospheric Administration (NOAA) and the U.S. Fish and Wildlife Service permit impacts on certain protected species under various statutes, and the U.S. Army Corps of Engineers permits obstructions to navigation and all permits for projects in the Great Lakes under the Rivers and Harbors Act.19 At the state level, state governments oversee generation, distribution, retail sales, public utility commission approvals, and energy solicitations. They are also instrumental in the regional transmission organizations (RTOs) and independent system operators (ISOs) that operate electric grids in much of the country. The states also have a regulatory role under the Coastal Zone Management Act to ensure projects are consistent with state coastal zone management programs and regulations.20 Local governments and local laws have a role in siting and establishing interconnections to the onshore grid.

In addition to jurisdictional issues, there are other legal barriers. Offshore wind turbines must be installed by ships (obviously), which means compliance with the Jones Act. The Jones Act requires that any goods transported between US ports be done on US-built ships, staffed with a US crew, and flying a US flag. However, the installation of offshore wind turbines requires special Wind Turbine Installation Vessels (WTIVs), and there are currently no WTIVs that are Jones Act compliant (though one is under construction). Constructing offshore wind turbines thus currently requires a sort of ballet where US-flagged barges bring the components from port to the installation point, where they’re then installed by a foreign flagged WTIV.

Beyond legal and permitting difficulties, offshore wind in the US often has to overcome significant local opposition. Offshore wind farms, for instance, are typically opposed by commercial fishing interests, as they argue it puts fish stocks at risk and makes vessel navigation more difficult, and offshore wind projects are often sued by commercial fishing organizations.

Offshore wind turbines are also often opposed by local residents. Even though they’re built several miles out to sea, they’re often visible from the shore. And because coastal real estate is a) often purchased specifically for the view, and b) expensive, this creates a built-in group of wealthy opponents who are worried about their “viewshed” for any offshore wind project, and have the resources to try to stop it. The US’s first attempt at a large offshore wind project, Cape Wind, was sued 32 times (and ultimately canceled), mostly by the William Koch led “Alliance to Protect Nantucket Sound,” a collection of wealthy residents who didn’t want to see wind turbines from their expensive Cape Cod real estate. (According to Koch, then-president George W Bush was in favor of the project mostly because it would annoy Senator Ed Kennedy, who sailed in the area). Cape Wind was closer to shore (4.9 miles) than more recent offshore wind projects, but more recent projects still engender opposition from wealthy NIMBYS.

Other than a small 12 MW pilot project off the coast of Virginia, every offshore wind project in the US has had a lawsuit filed against it.

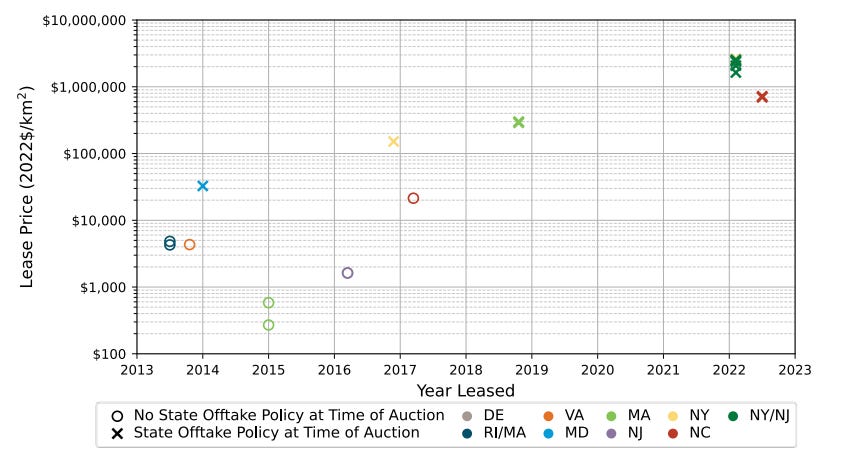

Despite these difficulties, the US is starting to pivot towards offshore wind. As of 2021 8 east coast states have offshore wind electricity targets, and the Biden administration has established a goal of 30 GW of offshore wind by 2030. The BOEM recently held several record-breaking lease auctions for offshore wind sites.

Two offshore wind projects are currently under construction off the coast of Massachusetts (South Fork Wind Farm and Vineyard Wind 1), with a total capacity of 932 MW, and the US has another 17,000 (!) MW of offshore wind projects in the permitting stage, most of which are waiting on an environmental impact statement to be completed.

This is mostly a recent development (projects in permitting have increased 9-fold over the past 3 years), but relative rates of increase in “permitting “ vs “under construction” suggests that permitting is likely to continue to be a bottleneck for US offshore wind (and if it’s resolved, it might immediately run into the bottleneck of available installation vessels, either due to Jones Act restrictions or because they’re all being used by China).

Coastal jurisdiction can be very complicated. Our town had a dead whale on its beach. The town couldn't touch it. The county couldn't touch it. The state couldn't touch it. The Coast Guard couldn't touch it. The federal government couldn't touch it. Luckily, one of the local tribes was still allowed, by a treaty recently reinforced by a court decision, to hunt whales, and they agreed to move it.

Offshore wind power has a lot of possibility in the US, especially along the eastern coast, an area with a demand for a lot of power. To be honest, I'm glad to see the Jones Act pushing the US to build the appropriate support vessels. That's the kind of thing that the act was set up to do.

There is a very interesting different design from T-Omega. I'd like to hear your comments on it.

https://newatlas.com/energy/t-omega-floating-wind/