“No inventions; no innovations," a History of US Steel

Last week, US Steel announced it was being acquired by Japanese steel company Nippon Steel. The milestone gives an opportunity to look back at what once was the largest and most important company in the US (and arguably the world), and how it slowly declined. Prior to the acquisition announcement, US Steel had a market cap of around $8 billion, not even enough to put it in the Fortune 500 (it would come in at around #690, slightly below the Texas Roadhouse restaurant chain).1 Over its lifespan, the company slowly but steadily lost market share and importance. When it was formed in 1901, it was by far the largest company in the world, and produced nearly 2/3rds of American steel. Today, it makes just 12% of American steel, around a third of the steel that it made in 1955, and employs around the same number of people as online pet retailer Chewy.

How did a once mighty industrial titan fall so far? Let’s take a look.

Origins and early years of US Steel

By the turn of the 20th century, the American steel industry had eclipsed Britain to be the largest and most efficient in the world. In 1896, an engineer for the Pennsylvania Steel Company wrote that “within the last decade America has made marvelous developments in her iron industry, until she now leads the world in the quantity of her products and bows to none in their quality.” Relentless competitors like Andrew Carnegie of Carnegie Steel had, in the course of expanding their steelmaking capacity and acquiring market share, steadily driven down the price of steel, which fell by more than 80% between 1870 and 1896.

But these successes had come at a cost. Steel production was subject to very large economies of scale: the larger your blast furnaces, and the more Bessemer converters and open hearth furnaces you operated, the cheaper making steel became. And because of the high fixed costs of these facilities, producers were incentivized to keep them full, cutting prices to just above the marginal cost of production in times of low demand. The result was chronic overcapacity and as steelmakers built ever-larger facilities and tried to underprice each other: at the end of the 19th century, nearly half of steelmaking capacity in the US went unused each year.

There was thus a growing desire for consolidation of the industry. If many competing firms were combined, production volumes of the new firm would rise and duplicate plant could be eliminated, enabling even greater economies of scale and lowered costs. The instigating event for such a merger was a banquet of bankers and industrialists in 1900, where Carnegie Steel president Charles Schwab spoke of the potential benefits of industry rationalization via merger. Less than 4 months later, it was done. Organized by JP Morgan, a new company was created by combining Carnegie Steel and Federal Steel, along with a hodgepodge of smaller companies including National Steel, American Sheet Steel, and American Hoop.2

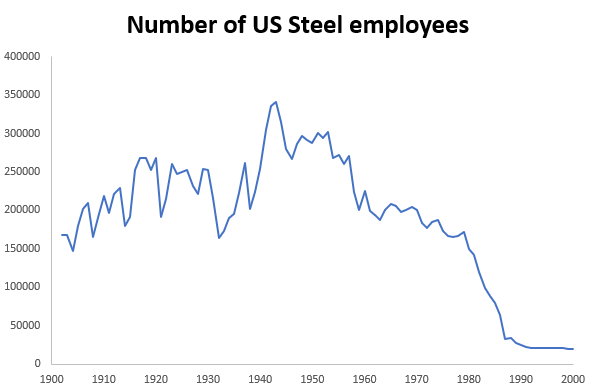

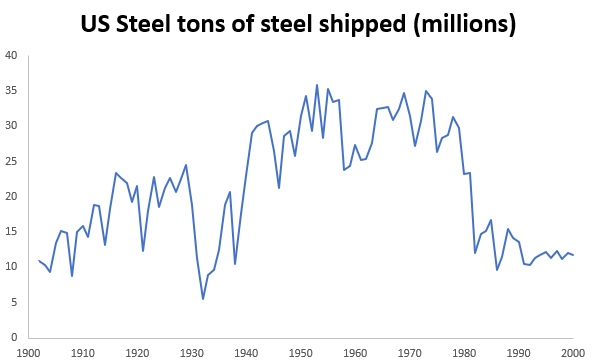

The new company, US Steel, was a monster. The first company to be worth more than $1 billion, the company had 168,000 employees and produced just under 9 million tons of steel annually, over 60% of all the steel in the US. And it quickly grew even larger. By 1917 US Steel (now up to 268,000 employees) was more than 3 times as large as the next largest company, AT&T, and had more than 7 times as many employees as Standard Oil when it was broken up.

The decades prior to the formation of US Steel were characterized by cutthroat competition, but that ended with the formation of US Steel. The head of the new company, Judge Elbert Gary, was a fundamentally conservative businessman, and his desire was to bring stability to what was a cyclical and chaotic industry. Whereas previously companies like Carnegie Steel would constantly cut prices to achieve greater market share and drive their competitors out of business, Gary set (generally) higher prices, and kept them high even as demand for steel fluctuated. Though its size did give it production cost advantages, these savings were retained as higher profits rather than passed on to the consumer. Gary was, according to former managing director of Carnegie Steel James Gayley, “opposed to the old method of going out into the market and slashing prices in order to get business.” To maintain prices in the face of fluctuating demand, Gary would gather the industry’s leadership together in regular “Gary Dinners,” where price levels would be agreed upon and Gary would “exhort the chairmen, presidents, or other major owners of steel companies to maintain rank.” Those who refused to cooperate would be “disciplined” by the others. Many former Carnegie Steel executives, schooled in the intense competition of the Carnegie years, were allergic to this strategy, and departed for other steel companies.

Gary proved adept at navigating the company through a cultural climate that was increasingly hostile towards potential monopolies. Under his leadership, the company successfully fought off a Justice Department lawsuit to break up the company as an illegal monopoly. (Perversely, the court ruled that the Gary Dinners proved that US Steel did not have the power to set prices, and thus couldn’t be a monopoly). But other threats proved harder to cope with. US Steel was consistently behind on adopting the latest steelmaking technology, and was often forced to license technologies from more forward-looking companies (some of which were run by former Carnegie men). A 1936 magazine article described early US Steel company policy as “No inventions; no innovations.”

In 1902, for instance, a man named Henry Grey invented what was known as a “Universal Beam Mill.” At the time, beams were made in the shape of an uppercase I, with a tall vertical web capped with narrow flanges at the top and the bottom. If you wanted wider flanges capable of carrying heavier loads, you would need to weld or rivet steel plates to the beam, an expensive and time-consuming process. The Universal Mill made it possible to roll wide-flange beams in a single operation, eliminating the process of attaching extra steel plates. Grey first brought his mill design to US Steel, but it was rejected by the finance committee. Instead, the first Universal Mill in the US was built by Bethlehem Steel, run by former Carnegie president Charles Schwab. Faced with declining market share in the growing construction steel market (which made heavy use of wide-flange steel beams), US Steel was ultimately forced to license the Universal Mill from Bethlehem in 1926.

The same pattern repeated for other new technologies. In the 1920s, technology for making large-diameter pipe by electrical resistance welding was invented. Though it was (supposedly) first offered to US Steel, the company again passed, only to adopt it several years later to keep up with its competitors. Around the same time, technology for continuous rolling of wide sheets of steel was invented, which greatly reduced production costs. US Steel had investigated continuous sheet rolling as early as 1902, but had abandoned its efforts. Instead, it was once again forced to license the technology from others to remain competitive (though in fairness, it was one of the first manufacturers to license it).

More generally, US Steel’s enormous size made it unwieldy and difficult to manage. It took time for information to filter up through the many layers of management between the factory floor and company leadership, and to get all of the disparate operations of the company moving in the same direction. This, on top of the fundamental conservative culture created by Gary, and the lack of top management talent as former Carnegie executives abandoned the company, caused US Steel to steadily lose market share to its more agile rivals. The company continued to grow, but other companies grew faster. By 1941 US Steel’s output had risen to nearly 30 million tons of steel annually, triple what it made when it was founded, but its market share had fallen from over 60% to around 35%.

US Steel in the post-WWII era

At the end of WWII, the American steel industry was an unchallenged juggernaut. During the war, American steel production had risen by more than a third, while the steel industries of most other countries had been nearly wiped out. By 1945, America was producing over 60% of the world’s steel. American steelmakers had the latest technology, unparalleled expertise, the largest economies of scale, and easy access to resources such as iron ore and coal. In 1945, the president of the US Steel Export Company George Wolf testified before congress that “the European steel industry is still far behind that of the United States, product, quality, and cost wise,” and that the gap was “an ever-widening one.” Japan, which would later emerge as a steel juggernaut, wasn’t even on the radar, producing just 0.56 million tons in 1946 against America’s 66 million tons. US Steel continued to dominate the industry, producing more than twice as much steel as the next largest company (Bethlehem Steel), and averaging around 30% of American steel output in the mid-1950s.

With seemingly no rivals on the horizon, American steel companies, including US Steel, became complacent. The post-war years are sometimes described as the “dodo period” of the American steel industry, as it steadily raised prices (steel prices rose at 7% annually between 1947 and 1957) and enjoyed large profits while ignoring the progress that was taking place in other parts of the world.

As American steelmakers built new capacity to meet post-war demand (by 1962 American steel capacity reached 154 million tons annually, nearly twice the production at the end of WWII), they did so using existing steelmaking technology, primarily the open hearth furnace. In an open hearth furnace, a combination of liquid pig iron from a blast furnace and steel scrap is placed in a large crucible, which is then heated using burning gas blown through a regenerative heat exchanger. In 1954, over 90% of steelmaking capacity in the US was open hearth furnaces, with the balance a mix of electric arc furnaces and Bessemer converters.

But in 1952, a new steelmaking technology appeared, the Basic Oxygen Furnace (BOF). The BOF was in a sense a refinement of the earlier Bessemer converter, the first technology for mass-producing steel. Whereas the Bessemer converter worked by blowing air through liquid pig iron from below, the BOF worked by blowing pure oxygen into pig iron from above. Oxygen furnaces had been conceived as early as the mid-19th century, but weren’t feasible to build until pure oxygen began to be made on an industrial scale in the 20th century.

The open hearth furnace replaced Bessemer converters because the latter was difficult to control, tended to result in nitrogen-embrittled steel, and was limited in the types of ore it could use. But open hearths came with drawbacks. They were more expensive to build, ran slower, and required much more fuel than Bessemer converters. Only cheap scrap metal, which could be remelted in an open hearth furnace along with liquid pig iron, made them economical to operate.

The BOF, by contrast, had many of the benefits of the Bessemer converter (rapid conversion of iron to steel, low fuel and labor costs, comparatively cheaper to build) while eliminating many of its drawbacks (nitrogen embrittlement, limitations on types of ore it could use).

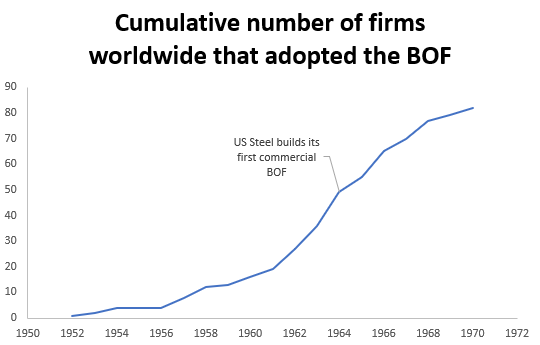

The first commercial BOF was built in Austria in 1952, and diffused through the industry as other companies experimented with it. By the end of the 1950s, it was clear that the BOF could produce steel more cheaply than the open hearth furnace (and in fact, no new open hearth integrated steelworks were built in the US after 1958).

But US Steel was once again slow to adopt the technology. Reluctant to abandon expensive open hearths that had years of useful life left, as late as 1962 US Steel executives were arguing that open hearth steel would remain competitive. US Steel didn’t build its first BOF until 1964, well behind other American companies like Kaiser Steel, which by 1964 was making 43% of its steel in BOFs.

Though US Steel was once again a laggard, it was emblematic of the entire US Steel industry, which was comparatively slow to adopt the BOF. By the time US Steel built its first BOF, the BOF was producing around 17% of steel in the US, compared to around 55% of steel in Japan.

And the BOF wasn’t the only steel technology where Japan was pushing ahead of America. In pursuit of ever-larger economies of scale, Japan went far beyond the US in the size of its blast furnaces. By the mid-1970s, average blast furnace size at Nippon Steel was 4 times the average at US Steel, and by 1977 more than half the blast furnaces in Japan had a volume of more than 2000 cubic meters, compared to just 2.6% of furnaces in the US. When US Steel had trouble with its own large blast furnace at its Gary Works, it was eventually forced to turn to the Japanese for help, who by then had much more experience than Americans operating very large furnaces.

A similar trajectory occurred with continuous casting technology, which produced continuous slabs of steel instead of individual ingots, and thus eliminated much of the rolling required for steel production. Though US firms pioneered much of this research, other countries adopted it more quickly. By 1975, only 9% of steel was continuously cast in the US, compared to 31% in Japan and 24% in West Germany. Here again, US Steel lagged, and didn’t widely adopt continuous casting until the early 1990s.

Thus, by the early 1960s cracks in America’s seemingly unassailable steel industry were beginning to show. Foreign producers like Japan had expanded their industries and adopted the newest steelmaking technology like the BOF and continuous casting. American steelmakers like US Steel, saddled with outdated technology and high labor costs, found themselves under threat from foreign producers for the first time. By 1958 some steelmakers in Germany and Japan were able to compete on price with US producers, and by the mid-1970s input costs for Japanese steel (ore, labor, coking coal, etc.) were nearly half those of US costs. Between 1955 and 1970 steel imports to the US increased by more than factor of 10, going from less than 2% of US production to more than 15%, and continued to rise.

In the face of foreign pressure, US Steel could no longer maintain the “price leadership” it had in the past, setting whatever price it wanted and encouraging the rest of the industry to follow suit. The company continued to lose ground to its more nimble rivals, who now included overseas competitors. By 1971, it was still the largest steel company in the US, but had been eclipsed in size by Japanese steelmaker Nippon Steel. Its annual output of steel was just over 27 million tons, less than it had produced in 1941, and its share of the US market had fallen to around 24%.

The American steel industry responded to the rise of foreign producers not by trying to improve their operations, but by demanding government protection from “unfair” foreign trade practices. In 1968, steel producers in Japan and Europe, at the behest of President Lyndon Johnson, agreed to artificially restrict their steel exports to the US. This was intended to give US producers “breathing room” to modernize their facilities and improve operations, though this didn’t occur (in fact, capital investment by American steelmakers declined after the agreements). And though pressure had been temporarily removed, things were about to get much worse for US Steel and the American steel industry.

The steel crisis and the rise of the minimill

Having temporarily fended off foreign threats, American steel production continued to climb. In 1973, right around Hyman Roth’s boasts that their mafia operations were “bigger than US Steel,” America produced 137 million tons of steel, more than any other country in the world. While not the unrivaled behemoth it once was, US Steel was still the 13th largest company in the US by revenue, and the largest steelmaker in the US.

It was widely predicted that demand for steel would continue to rise, as it had for most of the 20th century. In 1972, chairman of US Steel Edwin Gott predicted that worldwide demand for steel would rise 25% by 1980. Countries around the world expanded their steelmaking capacity in anticipation.

Instead, demand for steel stagnated. Between 1973 and 1984 worldwide demand for steel was essentially flat, and in industrialized countries it declined by around 25%. Steelmakers around the world, faced with large amounts of excess capacity, were incentivized to sell steel for just above the variable costs of production, “dumping” it on foreign markets. It’s somewhat unclear if such dumping actually occurred, but steel imports to the US continued to rise through the 1970s even as overall demand dropped. And US Steel was hurt most of all: nearly all of the loss in market share to foreign steelmakers came at the expense of US Steel.

American producers once again demanded government protection from foreign competition. They filed dozens of “antidumping” cases under the Trade Act of 1974, and secured other protectionist measures such as a “trigger price mechanism” in 1978 (which prevented foreign steelmakers from selling below their total costs of production) and a new round of voluntary export restrictions in 1984.

These measures helped stave off foreign competition. Steel imports declined from 26 million tons in 1984 to 17 million tons in 1989. But they couldn’t stop a threat that was emerging from within the US: the minimill.

Historically, steel had been produced in large, integrated steelworks. Iron ore would be turned into pig iron in a blast furnace, which would then be turned into steel in an open hearth or basic oxygen furnace. From there, the steel would be cast into ingots or slabs and then rolled into various shapes: wire, rods, plate, beams, sheets, and so on.

But in the late 1960s, a new type of steelmaking facility began to appear, the minimill. The minimill made steel not by processing iron ore, but by remelting scrap steel in an electric arc furnace. By eliminating the blast furnaces which turned iron ore into pig iron, minimills were not only much cheaper to build than integrated steelworks (as little as 1/10th the cost per ton of steel they produced), but they could profitably be built much smaller. And the scrap steel they required was widely available thanks to the previous transition to the BOF, which used much less scrap than the open hearth it replaced.

Because scrap steel was often contaminated with other metals such as copper that couldn’t be easily separated, minimill steel was initially lower quality than BOF steel, and minimills were only competitive in products where such quality didn’t matter, like concrete reinforcing steel. But as minimill technology improved, they began to take more and more share from large, integrated steelmakers like US Steel. Between 1974 and 1994 steelmaking capacity of integrated producers fell by more than 50%, while the capacity of minimills increased by 360%, reaching 30% of American steelmaking capacity.

Thus, by the early 1980s, US Steel was in trouble. Its market share had fallen to around 20% of the US market, and it was massively less efficient than both low-cost steelmakers abroad and increasingly capable minimills at home. Whereas for much of its history it had been one of the most profitable American steelmakers thanks to its scale, it was now one of the least profitable.

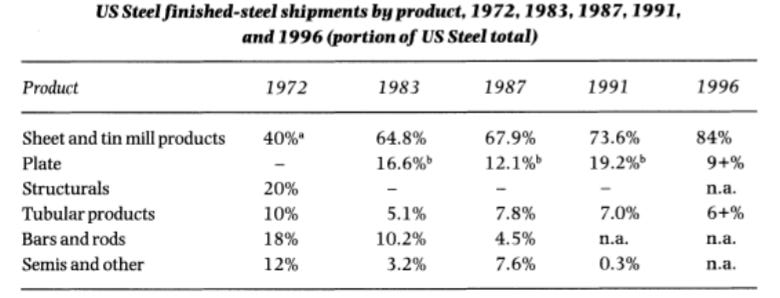

US Steel responded to these threats with bitter medicine. It cut tens of thousands of jobs and closed dozens of plants, reducing employment from 171,000 in 1979 to less than 21,000 in 1995. It divested many of its auxiliary operations like mines, warehouses, and bridge construction. It abandoned market segments like rebar and heavy structural steel where it couldn’t compete with the minimills, and instead focused on things like sheet steel products (which minimills still had trouble with), concentrating operations in a small number of large plants. By 1985, US Steel had closed more than 150 facilities, and by 1998 its steelmaking capacity was down 71% from its peak in 1973.

(US Steel was far from the only integrated producer that needed to take such drastic steps. The entire American steel industry (and indeed, the worldwide steel industry) shed hundreds of thousands of workers as it dealt with its overcapacity.)

This tough medicine worked. Productivity increased enormously, and US Steel became one of the most efficient integrated steelmakers in the world (though it still had trouble matching the productivity of the most efficient minimills).

The new, lean US Steel proved to be a scrappy competitor. As imports continued to rise (reaching 37% of US production in 1998), and minimills continued to take market share (electric arc furnaces reached 47% of US production by 2000), US Steel survived where many of its competitors didn’t. Kaiser Steel, the company that had beaten US Steel to the punch in installing BOFs, closed shop in 1983 after 18 quarters of losses. Between 1997 and 2001, 30 steel companies declared bankruptcy, including longtime rival Bethlehem Steel.

But the new, lean US Steel still continued to be a step behind on technological innovation. US Steel didn’t adopt the minimill until 2020, when it acquired a minimill company and built its own minimill in Alabama. (Minimills now produce around 25% of US Steel’s domestic output.) Companies like Nucor beat it to the punch with things like thin slab casting technology.

Today, the momentum in the American steel industry is clearly with the minimills. An ever-larger fraction of American steel is made in electric arc furnaces. Minimill company Nucor passed US Steel in production in 2015, and today is the largest steel producer in the US.

Conclusion

Arguably, US Steel has been a disappointment since the day it was formed. It was created as a fundamentally conservative reaction to the vicissitudes of the steel industry, and this guided its early years and shaped its culture. The economies of scale it achieved were never passed on to the consumer, and instead it used its size to bully other steelmakers and extract money from consumers. When this stopped working, it used its political influence to prevent consumers from buying low-cost foreign steel. Improving the efficiency of its operations was something it did as a last resort when left with no other options.

The company’s large size made it unwieldy to manage, and it was late to every major advance in steelmaking technology of the last 100 years, from continuous rolling to the basic oxygen furnace to the minimill. When the company did try its hand at technology innovation, it reliably made missteps. In some cases, like with continuous rolling, it gave up too early, while in other cases it spent many years unsuccessfully developing a technology. In the 1950s, for instance, it spent many years trying to develop an alternative to the BOF that blew oxygen in from the side, long after other producers had given up on the technology. And in the 1970s it tried to develop another alternative to the BOF called Q-BOP that likewise didn’t seem to pan out. As far as I can tell, no major steelmaking technology over the last century came out of US Steel.

The US Steel of today is a far cry from the industrial giant of the 20th century. But being transformed into a lean, competitive company doesn’t seem to have changed its fundamental culture, a company that's content to be a follower, rather than a leader in technological development and pushing the industry forward.

The acquisition announcement, however, has juiced the stock price a bit.

Carnegie himself would retire and spend the rest of his life philanthropically distributing the $225 million (over $8 billion in 2023 dollars) he earned from the buyout of Carnegie Steel.

From a layman: this was fascinating to read. So clearly constructed and interesting. Thank you!

The rise of mini-mills like Nucor in the '80s and '90s was ignored by the lame-stream media of the day. Also, Nucor was a non-union shop, so they were often equated to insect-life by labor sympathetic journos.