Reading List 02/01/2025

Coal to gas conversions, India’s data center plans, fusion fundraising, China’s self-driving cars, and more.

Welcome to the reading list, a weekly roundup of news and links related to construction, infrastructure, and industrial technology. This week we look at coal to gas conversions, India’s data center plans, fusion fundraising, China’s self-driving cars, and more. Roughly 2/3rds of the reading list is paywalled, so for full access become a paid subscriber.

No essay this week, but I’m working on an analysis of interconnection queue data that should be out early next week.

Coal to gas conversions

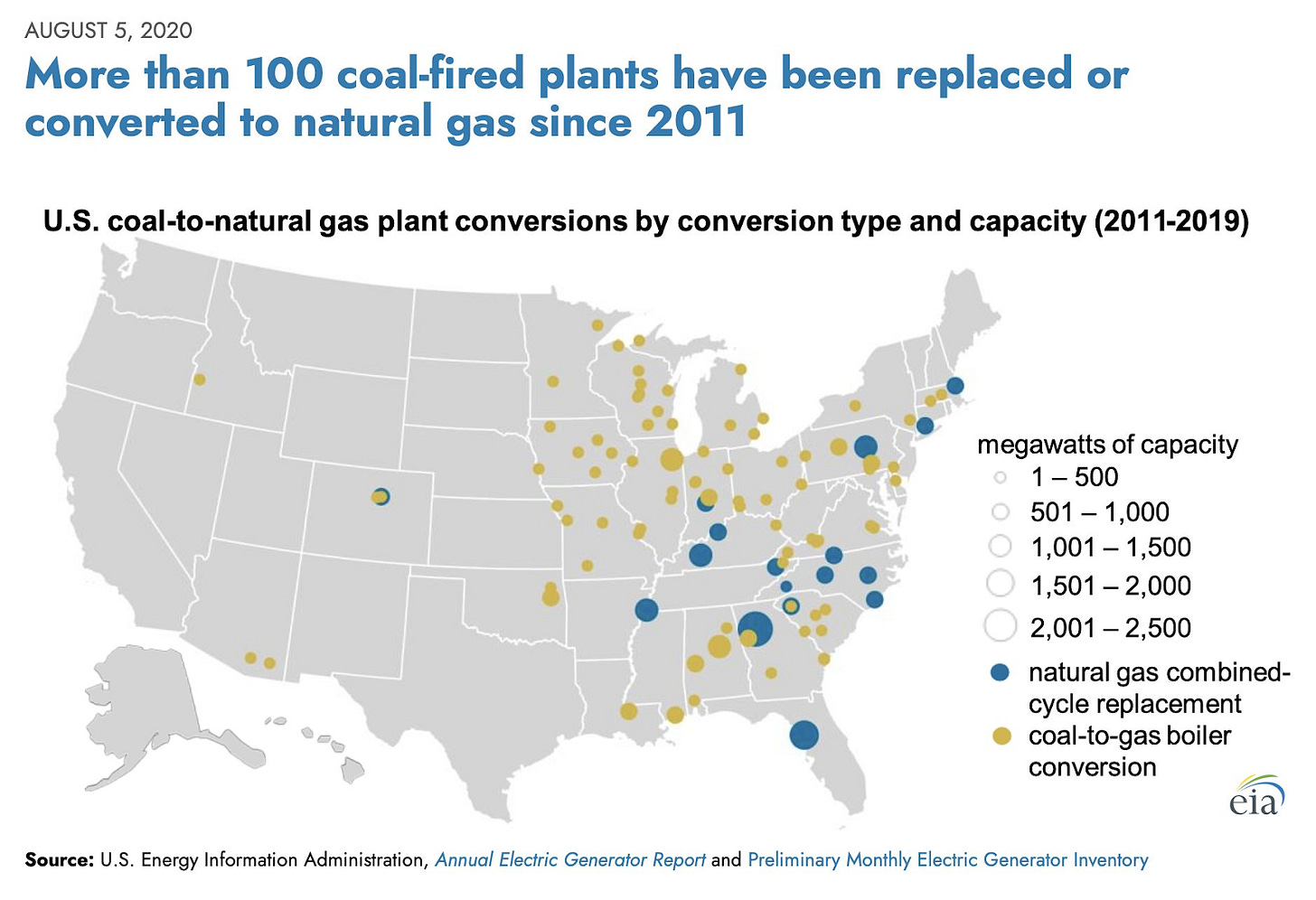

The amount of electric power generated by coal plants has declined significantly in the US over the past several years. Between 2007 and 2019 coal-generated electricity fell by more 50%. Via the EIA.

In part this was due to the shale revolution, which made natural gas cost-competitive with coal-fired electricity. Many coal plants have been retired, but others have been converted to burn natural gas. With both coal and gas you’re burning fuel to turn water into steam that drives a turbine, so coal plants can be converted by changing the boilers to burn natural gas. Between 2011 and 2019 104 coal plants in the US were repurposed to burn natural gas. From Jesse Peltan:

Icon layoffs

We’ve looked a few times at Icon, the 3D printed home startup operating out of Texas. I’ve generally been various shades of skeptical of the company, depending on what sort of progress they appear to be making. They’ve improved their technology and reduced costs, but many of the fundamental issues with the technology still remain, and they’ve announced no major new projects or funding rounds, so they’re steadily burning cash. Now they’ve had a huge round of layoffs. From Techcrunch:

It is unknown just how many employees ICON will have after the layoffs take place, which according to the letter, will occur on March 8. The Austin Business Journal reported that ICON had about 400 employees “at last count,” so a layoff of 114 people would be more than 25% of its workforce. A spokesperson for the company said only that ICON had “less than 400 employees” prior to this workforce reduction…

An ICON spokesperson on Thursday told TechCrunch the company’s priority now is to accelerate the development of Phoenix, its line of multi-story 3D printers “and begin putting the robotic technology into the hands of builders.”

“While our mission remains to develop these intelligent machines to build humanity’s future, we will continue to design and build a selection of key projects across residential, hospitality, social/affordable and those within the Department of Defense with a more streamlined team,” the spokesperson added.

Reading between the lines here, it seems like there’s not any major homebuilding projects for them on the horizon, which isn’t great. Presumably they’re banking on the capabilities of their next generation printer to help them get more projects or another round of investment. We’ll see if that happens.

India’s huge data center

On the heels of OpenAI’s five gigawatt Stargate data center announcement, India is announcing its own huge data center project. From Bloomberg:

The 67-year-old billionaire is buying Nvidia Corp.’s powerful AI semiconductors and setting up a data center in the town of Jamnagar that’s expected to have a total capacity of three gigawatts, according to people familiar with the matter, who asked not to be identified because the details aren’t public. That would make it far bigger than any data center now operating…

Ambani’s project, if it goes ahead as envisioned, stands out for its sheer size. The largest data centers operating now are less than 1 gigawatt, according to data provided by market intelligence firm DC Byte, which would make his several times larger than what’s on the market.

In June of last year, Leopold Aschenbrenner, noting the ever-increasing compute demands for AI training, projected we’d see 10 gigawatt data centers by 2028, up from ~0.1 gigawatt data centers in the early 2020s. It seems like these predictions might be borne out.

DeepSeek

However, many folks are now wondering whether all this data center demand will actually materialize. Earlier this week Chinese hedge fund company High-Flyer made waves with the latest version of their AI model DeepSeek, which has capabilities comparable to many of the latest US models but required a fraction of the cost (and thus power/computation) to train. From the Wall Street Journal:

On Jan. 20, DeepSeek introduced R1, a specialized model designed for complex problem-solving.

“Deepseek R1 is one of the most amazing and impressive breakthroughs I’ve ever seen,” said Marc Andreessen, the Silicon Valley venture capitalist who has been advising President Trump, in an X post on Friday.

DeepSeek’s advances sparked a selloff led by chip shares early Monday on concerns over whether the huge spending by U.S. tech giants on leading-edge semiconductors and other AI infrastructure was justified. The tech-focused Nasdaq fell 3% and Nvidia slid more than 10%.

DeepSeek’s development was led by a Chinese hedge-fund manager, Liang Wenfeng, who has become the face of the country’s AI push. On Jan. 20, Liang met China’s premier and discussed how homegrown companies could narrow the gap with the U.S.

Specialists said DeepSeek’s technology still trails that of OpenAI and Google. But it is a close rival despite using fewer and less-advanced chips, and in some cases skipping steps that U.S. developers considered essential.

Mike Byrd noted on Twitter that the Nvidia drop was roughly equal to the value of the entire Mexican stock market. And tech stocks and chip manufacturers weren’t the only stocks to fall. Electrical infrastructure stocks did too. From Reuters:

Shares of U.S. power, utility and natural gas companies sold off on Monday in some of the biggest recorded one-day drops, as new AI technology from Chinese start-up DeepSeek cast doubt on a projected surge in U.S. electricity demand and tech spending.

Power producers were among the biggest winners in the S&P 500 last year on expectations of ballooning demand from the energy-guzzling data centers needed to scale Big Tech's artificial intelligence technologies.

The wider adoption of AI models like the one developed by DeepSeek, which it says it built in under two months and is cheaper than models currently used by U.S. companies, could result in less electricity demand overall and result in a smaller power build-out, analysts and economists said.

However, this (apparently) doesn’t mean that DeepSeek has massively leapfrogged US companies in how efficiently these AI models can be trained. AI researcher Dario Amodai provides more context:

DeepSeek does not "do for $6M what cost US AI companies billions". I can only speak for Anthropic, but Claude 3.5 Sonnet is a mid-sized model that cost a few $10M's to train (I won't give an exact number). Also, 3.5 Sonnet was not trained in any way that involved a larger or more expensive model (contrary to some rumors). Sonnet's training was conducted 9-12 months ago, and DeepSeek's model was trained in November/December, while Sonnet remains notably ahead in many internal and external evals. Thus, I think a fair statement is "DeepSeek produced a model close to the performance of US models 7-10 months older, for a good deal less cost (but not anywhere near the ratios people have suggested)"...

All of this is to say that DeepSeek-V3 is not a unique breakthrough or something that fundamentally changes the economics of LLM’s; it’s an expected point on an ongoing cost reduction curve. What’s different this time is that the company that was first to demonstrate the expected cost reductions was Chinese. This has never happened before and is geopolitically significant. However, US companies will soon follow suit — and they won’t do this by copying DeepSeek, but because they too are achieving the usual trend in cost reduction.

German car manufacturing

The Wall Street Journal has an excellent piece on Germany’s economic struggles, not least of all in car manufacturing.

Carmaker Audi, headquartered here near the Danube river, used to pump over €100 million a year in municipal tax into Ingolstadt’s coffers through its parent, Volkswagen, but those flows dried up over a year ago. Audi in November reported a 91% decline in operating profit for the three months through September and has been cutting thousands of jobs in Germany.

Audi’s business in China, where Germany’s flagship car industry used to make a big chunk of its sales and an even bigger chunk of profits, shrank by a quarter in the nine months through September from a year earlier. Chinese carmakers, once mocked by Western auto executives as primitive, have turned into formidable rivals, gobbling up market share in and outside China.

Slowing economic growth in China and growing competition from companies there have undercut German industry as a whole. Combined with exploding energy costs and the threat of new trade tariffs, the forecast is grim.

German carmakers and their suppliers have announced tens of thousands of job cuts. Germany’s manufacturing industry, the world’s third largest, has shrunk steadily for seven years. And Germany’s economy as a whole has contracted for the past two years, marking only the second back-to-back annual contraction in records dating back to 1951, according to Germany’s federal statistics agency.

Related, the Financial Times reports that Volkswagen is considering letting Chinese manufacturers take over its production lines:

Volkswagen is open to allowing Chinese carmakers to take over its excess production lines in Europe, as it grapples with falling demand and rising competition from the very same companies eyeing its factories.

Executives at Audi and VW’s eponymous flagship brand told the Financial Times that partnering with Chinese makers of EVs, which are looking to expand their footprint in Europe, was one option to address declining sales in the region.

“For sure, that is thinkable,” said Gernot Döllner, chief executive of Audi. Such a move would “lower the entrance barrier of these competitors”, adding: “I believe in free trade.”

Of course, German car manufacturers aren’t the only ones struggling. We’ve previously looked at how European, US and Japanese car makers are withering in the face of rising Chinese competition.