Reading List 02/15/25

California’s insurance bailout, Tesla’s declining sales, a Lunar tunneling machine, Heathrow’s planned third runway, and more.

Welcome to the reading list, a weekly roundup of news and links related to buildings, infrastructure, and industrial technology. This week we look at California’s insurance bailout, Tesla’s declining sales, a Lunar tunneling machine, Heathrow’s planned third runway, and more. Roughly 2/3rds of reading list content is paywalled, so for full access become a paid subscriber.

Tariffs

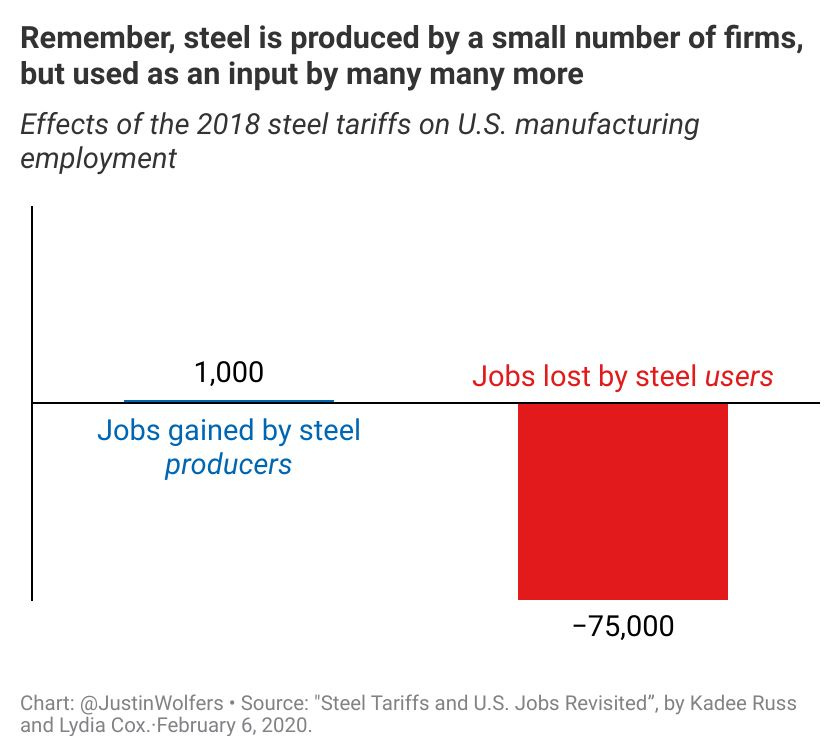

This week’s newsletter was about the potential impact of tariffs on the construction industry. For more on tariffs, Alex Tabarrok at Marginal Revolution points out the large negative impact of tariffs on steel. Since steel is an input to many parts of the economy, tariffs mean a small increase in US steel jobs at the expense of a large decrease in jobs elsewhere:

And earlier, temporary steel tariffs in 2002 and 2003 “led to a rearrangement of supply chains which led to long-lasting declines in exports and employment in steel using industries.”

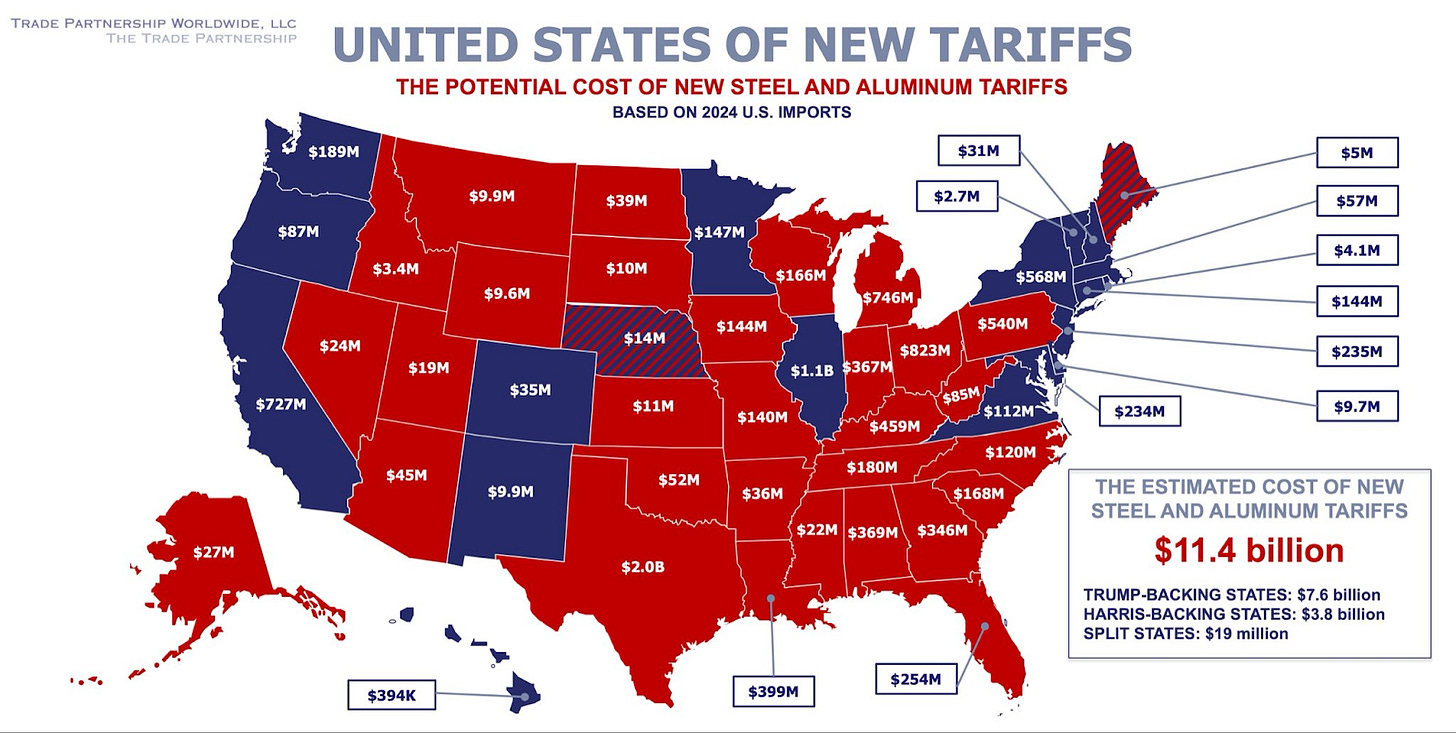

Related, on Twitter Scott Lincicome shared this map of the state-level impacts of Trump’s recent steel and aluminum tariffs.

And this 2019 Wall Street Journal article looks at the impacts of Trump’s 2018 washing machine tariffs:

President Trump’s tariffs on imported washing machines cost U.S. consumers about $1.5 billion a year, according to new research.

The paper released Monday found the tariffs raised the price of washing machines by 12%.

The prices of dryers, which weren’t subject to the tariffs but are often sold together with washers, also rose about the same amount, according to the research by Aaron Flaaen, a Federal Reserve economist; Ali Hortaçsu and Felix Tintelnot, both of the University of Chicago…

Foreign appliance makers such as Samsung Electronics Co. and LG Electronics Inc. responded to the tariffs by announcing plans to boost production in the U.S. and hire up to 1,600 new workers. Whirlpool Corp., a domestic manufacturer, said it would also hire an extra 200 workers.

The tariffs also produced $82.2 million in new government revenue between February 2018 and January 2019, according to the study.

But consumers paid the price, the research found. After taking into account the additional government revenue, each of those new jobs cost $817,000, the researchers found.

And Kevin Drum shared this figure of how the tariffs disrupted what had been a trend of falling washing machine costs.

See also this Noah Smith post on when it makes sense to have tariffs.

California insurance bailout

We’ve previously noted that increased disaster risk in some states is forcing many homeowners to get homeowners insurance from state-backed insurers of last resort, which are often underfunded, and that the LA fires would likely be catastrophic for California’s insurer of last resort FAIR. Now California is looking for private insurers (and ultimately homeowners statewide) to bail out FAIR. From Cal Matters:

After saying it would run out of funds by March, California’s last-resort fire insurance provider will impose a special charge of $1 billion on insurance companies — which will in turn pass the costs along to homeowners — the first such move in more than three decades.

The state Insurance Department today approved a request from the provider, the FAIR Plan, to impose the charge and ensure it stays solvent as it covers claims from victims of the Los Angeles County fires, the department said in an order by Commissioner Ricardo Lara.

Most California home and fire insurance customers will see temporary fees added to their insurance bills as part of the charge, known as an assessment — marking the first time insurance companies will have imposed an assessment directly on customers.

Data center investment

We previously noted that the apparently low training cost of China’s DeepSeek AI model had driven some to wonder whether enormous planned investments in AI data centers would be scaled back. The answer appears to be “no”, at least not yet. From the Wall Street Journal:

The four biggest spenders on the data centers that power artificial-intelligence systems all said in recent days that they would jack up investments further in 2025 after record outlays last year. Microsoft, Google and Meta Platforms have projected combined capital expenditures of at least $215 billion for their current fiscal years, an annual increase of more than 45%.

Amazon didn’t provide a full-year estimate but indicated on Thursday that total capex across its businesses is on course to grow to more than $100 billion, and said most of the increase will be for AI.

Their comments in recent quarterly earnings reports showed the AI arms race is still gaining momentum despite investor anxiety over the impact of China’s DeepSeek and whether these big U.S. companies will sufficiently profit from their unprecedented spending spree.

Related, Joe Weisenthal notes that capital spending is up economy-wide (though it’s not clear to me how much of this is driven by the AI investments of a few megacap companies). Note that this somewhat pushes against the idea that economic uncertainty created by Trump administration policies is hampering investment.

Tesla sales decline

Elon Musk’s actions at DOGE are apparently making him unpopular. Noah Smith points to this YouGov poll showing most US folks want Musk to have much less influence over the government:

This unpopularity seems to be affecting Tesla sales. Tesla sales in Europe are down significantly compared to last year, even though worldwide electric vehicle sales were up (though some of this appears to be driven by the timing of ramping up production for a new Model Y):

Tesla sales also seem to be dropping in the US, though the drop is smaller and it’s not obvious this isn’t just noise. From eletric-vehicles.com:

Tesla’s registrations in the U.S. dropped 10% year over year in January, Motor Intelligence estimates. The company registered 48,500 vehicles, down from the 53,830 recorded a year ago.

California New Car Dealers Association said on Monday that registrations in the state fell 12% from January 2024.

(This website, “eletric-vehicles.com”, is extremely sketchy, but the Motor Intelligence data seems to be correct.)

Tesla sales have also fallen in China, though I’d be surprised if that was due to concerns about Musk’s influence in US politics.