Reading List 03/01/25

Nissan courting Tesla, Europe’s Starlink competitor, Chinese semiconductor progress, ways to use existing interconnection capacity, and more.

Welcome to the reading list, a weekly roundup of news and links related to buildings, infrastructure, and industrial technology. This week we look at Nissan courting Tesla, Europe’s Starlink competitor, Chinese semiconductor progress, ways to use existing interconnection capacity, and more. Roughly 2/3rds of the reading list is paywalled, so for full access become a paid subscriber.

Jet engine reading list

This week's newsletter on jet engines required reading through a lot of books about them. Here's a few of the best ones I found.

For an extremely detailed, but accessible to the non-expert discussion of how a jet engine actually works, Rolls-Royce's "The Jet Engine" book is very good. It goes through, system by system, how a jet engine functions, starting with the high-level discussions of the thermodynamic cycle and then diving into things like compressor operation, fuel systems, secondary air, and so on. By far the best part of this book is the beautiful figures that accompany the descriptions.

Another useful book is The History of the Rolls-Royce RB211 Turbofan Engine. This is a great, detailed look at what it takes to bring a new jet engine to life (and it’s a great reference for understanding “why technology development is difficult” more generally), but it’s not an easy read. Recommend if you have a deep interest in either of those topics, but the general reader should look elsewhere.

I also found Aerodynamics: Inside the High-Stakes Global Jetliner Ecosystem good for discussion of development of recent jet engines (the geared turbofan and the CFM LEAP), and of airliner technology more generally. And Turbulent Skies: The History of Commercial Aviation is good for discussion of early jet airliner history. I also liked Not Much of An Engineer, the autobiography of Stanley Hooker, an early jet engine designer who worked for Rolls-Royce and rescued the RB211 program after it had gone sideways.

If watching videos is more your scene, check out AgentJayZ's youtube channel, who operates a jet engine repair shop and has hundreds of videos discussing various aspects of jet engines operation.

Hydropower

We've previously noted that hydroelectric dams are making something of a resurgence. Now Norway is making it easier to develop hydropower plants on protected rivers. Via the Guardian:

The Norwegian parliament has voted to open up protected rivers to hydropower plants, prompting fury from conservation groups who fear for the fate of fish and other wildlife.

The bill allows power plants bigger than 1MW to be built in protected waterways if the societal benefit is “significant” and the environmental consequences “acceptable”. It was voted through on Thursday as part of measures to improve flood and landslide protection.

And in the US, Charles Yang (formerly of the DOE and founder of the Center for Industrial Strategy) argues that the US should develop more hydropower. Via Utility Dive:

The federal government’s ownership of hydropower facilities offers a rare chance to fast-track solutions to load growth. Hydropower is also one of the lowest cost, baseload sources of energy generation, which makes it attractive to manufacturers with large loads, like polysilicon producers and data center developers. For instance, Iron Mountain Data Centers and Rye Development signed a 150-MW power purchase agreement, with Rye Development using the PPA financing to power non-powered dams across the mid-Atlantic.

The National Energy Dominance Council can leverage the direct federal control over hydropower and dam facilities to help meet load growth through several methods. The first is to power non-powered dams, similar to the Iron Mountain and Rye Development project. Only 3% of the nation’s dams are powered, but a Department of Energy study found that 4 GW of capacity could be added through powering existing dams, with the majority of large capacity opportunities being federal dams. Second, modernizing hydropower facilities, many of which are over 60 years old, could add another 5 GW of capacity while revitalizing outdated infrastructure.

Tesla, Nissan, and BYD

We’ve previously noted that Japanese car manufacturer Nissan has been struggling, partly due to increasing competition from Chinese manufacturers. The company was exploring a merger with Honda and Mitsubishi, but that has apparently fallen through. Now it seems to be looking to Tesla to help. From the Financial Times:

A high-level Japanese group that includes a former prime minister has drawn up plans for Elon Musk’s Tesla to invest in the struggling carmaker Nissan, following the collapse of its merger talks with rival Honda…

The group is hopeful Tesla will become a strategic investor because they believe the world’s largest pure electric-vehicle maker is keen to acquire Nissan’s plants in the US, the people said. The factories would help it boost domestic manufacturing in response to Donald Trump’s tariff threats.

The plan to approach Tesla comes after Nissan walked away from Honda’s $58bn merger proposal, spurring fears that Japan’s third-largest carmaker could fall into potentially hostile foreign hands, with Taiwanese iPhone assembler Foxconn, activists and private equity groups circling.

It’s not clear to me whether there’s any actual interest from Tesla (the proposal is being led by a “former Tesla board member”), or if new US plants would be of interest to Tesla in the face of what might be declining US sales.

In other Tesla news, the company has rolled out its “Full Self Drive” system in China. But Tesla’s system is just one of many competing systems. BYD is now offering its own driver assist system, “God’s Eye”, for free. From the Financial Times:

BYD, the Chinese electric vehicle maker that is Tesla’s biggest rival, has unveiled an advanced self-driving system that it plans to install on its entire model line-up including the Rmb70,000 ($9,600) Seagull budget hatchback.

Dubbed “God’s Eye”, the driving system was developed in-house by BYD and will equip the carmaker’s mass-market models with features commonly only found on upscale EVs such as remote parking via smartphones and autonomous overtaking on roads.

And it seems in general like China’s driving-assist space is getting crowded, with lots of manufacturers offering their own systems. Via Wired:

…Shanghai-based automotive commentator Mark Rainford of Inside China Auto has test-driven several Chinese L2+ cars, and he is more impressed with Huawei's Qiankun system than God’s Eye. Incidentally, continuing the deification nomenclature, Huawei's own General Obstacle Detection network for autos is also referred to as “GOD.”

Rival automakers XPeng, Nio, and Li Auto, aided by their early adoption of Nvidia’s Orin X tech, a system-on-a-chip (SoC) that’s used to power autonomous driving and AI applications, are also more impressive than God’s Eye, states Rainford. The three are vying with BYD, Huawei, and others to offer the first true Level 3 autonomous driving system.

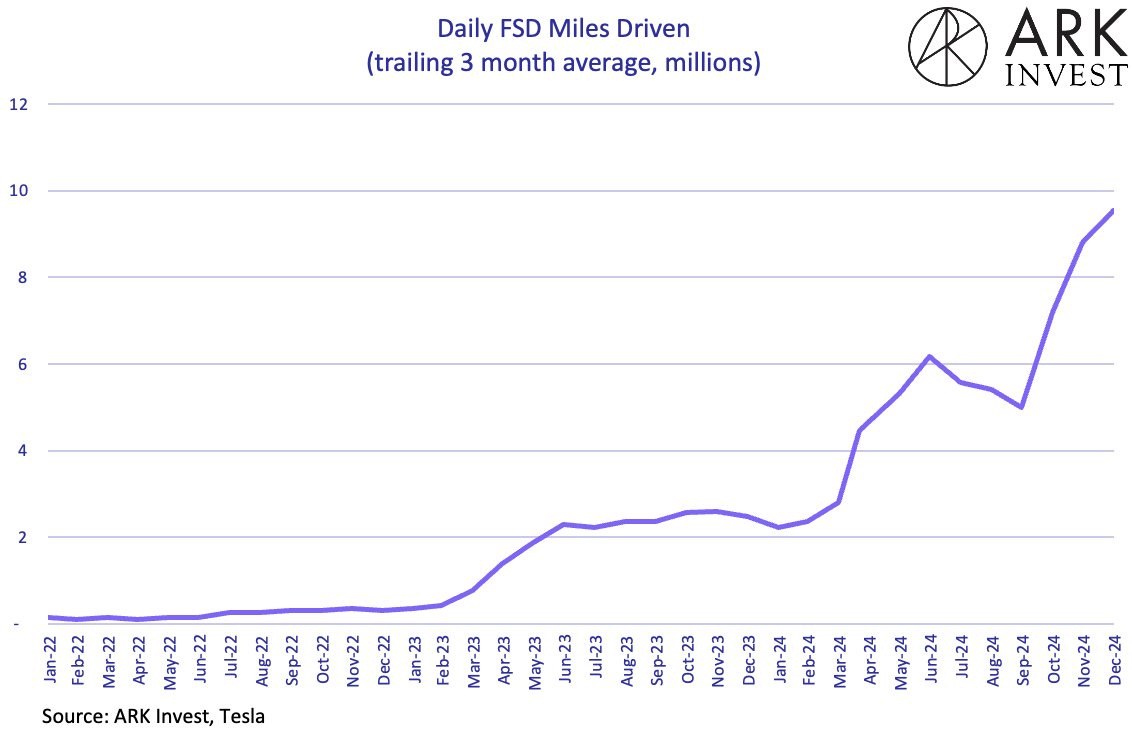

In other self-driving news, Brett Winton on Twitter notes that FSD makes up close to 10% of all Tesla miles driven.

Data centers

The AI capital spending spree continues. Meta is allegedly planning a $200 billion data center campus, though the company denies the report. Via Reuters:

Meta Platforms (META.O), opens new tab is in discussions to construct a new data center campus for its artificial intelligence projects, with potential costs exceeding $200 billion, The Information reported on Tuesday, citing people familiar with the matter.

Meta executives have informed data center developers that the company is considering building the campus in states including Louisiana, Wyoming or Texas, with senior leaders having visited potential sites this month, the report said.

And Amazon is building 1.3 gigawatts of diesel backup generators for a data center campus in Indiana.

Apple also announced it would spend $500 billion in the US over the next several years, though apparently this was mostly in-line with what it was already spending. Via the Wall Street Journal:

Apple announced plans Monday morning to spend more than $500 billion in the U.S. over the next four years. The outlay will include money spent with domestic suppliers and on the opening of a manufacturing facility to produce the servers needed to support the company’s artificial-intelligence service, called Apple Intelligence. The company also said it plans to open a facility in Detroit to train “the next generation of U.S. manufacturers.”

Unclear, though, is how much of the planned spending is actually new. Apple has spent about $1.1 trillion over the past four fiscal years on total operating expenses and capital expenditures—and Wall Street expects nearly $1.3 trillion in total spending over the next four years, according to consensus estimates by Visible Alpha. While Apple doesn’t break out its expenses per geography, about 43% of its revenue comes from the Americas region, which it defines as North and South America. Assuming the U.S. constitutes the large bulk of that number, and if spending is about in line with revenue, then a rough figure of 40% of projected global spending through the 2028 fiscal year equates to about $505 billion.

Last week we noted that Microsoft might be walking back some of its data center commitments, but the company has since denied this.

On the power side, GE Vernova (a manufacturer of gas, wind, and steam turbines), NRG energy (a power company), and Kiewit (a construction company) also announced a partnership to rapidly build several natural gas plants, with a total capacity of 5 gigawatts, to feed AI energy demands. More plants are apparently in the pipeline.

Outside the US, the United Arab Emirates is planning on spending enormous amounts of money on AI infrastructure. The Wall Street Journal has an article about Sheikh Tahnoon bin Zayed Al Nahyan, the UAE security advisor leading these efforts:

A new artificial intelligence fund he leads, MGX, is set to be infused with more than $50 billion from his wealth and other Abu Dhabi sources, according to people familiar with the fund. Billions of dollars more are set to be spent on AI by Group 42, a company he controls.

Tahnoon’s entities are part of the more than $70 billion the U.A.E. pledged to invest in France and Italy earlier this month. Last month, MGX was one of the few names mentioned backing Stargate, a $100 billion data center project announced at the White House to be led by SoftBank and OpenAI. It also has written big checks for OpenAI, Musk’s XAI and Amazon-backed Anthropic.

Even in an AI world awash in funds, Tahnoon stands out. While many are plunging tens of billions of dollars into concentrated areas—SoftBank is making a huge bet on OpenAI and the tech giants are heaving money at data centers—Tahnoon is planning to spread more money broadly around the fledgling sector than almost anyone else.

And way outside the US, a couple weeks ago we also mentioned Lonestar, a company that plans to build lunar-based data centers. IEEE Spectrum has an article looking into the company more deeply:

…on Earth, undersea cables often get cut, leading to outages. Natural disasters like hurricanes and earthquakes, as well as war, can also disrupt networks or destroy the data itself. The lunar surface is a much more predictable place—there is almost no atmosphere, and therefore no climate events to worry about. There is radiation, but it is fairly constant. And the moon is not a war zone, at least for now.

“We call it resilience as a service,” Stott says. “It’s like a whole new level of backup that we’ve never had before.”

The other motivation is data sovereignty. Over 100 countries worldwide have laws that restrict where certain data can be processed and stored, often to within that country itself. As a data center provider, it’s impossible to accommodate all potential customers in any one location, except in outer space. According to the United Nations’ 1967 outer space treaty, space and the moon are “not subject to national appropriation by claim of sovereignty,” and as such poses a loophole for data sovereignty laws. An American satellite is under American law, but it can carry a black box inside it that’s under British law, or any other country’s. A moon-based data center can host as many separate black boxes as needed, to accommodate all of its diverse customers.