How Batteries Are Making the Electrical Grid More Reliable

To operate reliably, the US electrical grid needs to balance supply and demand: to make sure, at any given moment, that the amount of electricity demanded by homes, businesses, and factories is equal to the amount being supplied by nuclear reactors, gas turbines, and other types of power plants. Historically, this was done by connecting and disconnecting power plants, or ramping their output up and down as demand rises and falls. Some power plants might operate at full output nearly continuously (“baseload” generation, like nuclear), while others might only be ramped up when demand spikes (“peaker” plants, like gas turbines) and ramped down when no longer needed.

Today, electrical grids have a new tool for balancing supply and demand and ensuring grid reliability: batteries. Because of their ability to charge and discharge, and because they can be ramped up to full power quickly, batteries excel at the grid-balancing tasks required to ensure electricity supply always equals demand, as well as letting us match supply and demand with intermittent sources of generation like wind and solar. With batteries, reliably meeting electricity demand can be done without relying solely on traditional, turbine-based power plants.

Battery storage is growing rapidly in the US. Between 2013 and 2023, battery storage power capacity increased by a factor of 100, and energy (power x time) capacity increased by a factor of 275. By the end of 2023 there were about 16 gigawatts of battery power capacity on the grid, equivalent to about 16 large nuclear reactors.1 In some states, like California and Texas, the rapid growth of battery storage has made batteries an increasingly important tool for maintaining a reliable grid.

A reliable grid means balancing supply and demand

Operating the power grid requires balancing supply and demand: ensuring that at any given moment, the load on the grid is matched by supply from various sources of electricity generation. If supply and demand don’t match, the result can be blackouts, brownouts, or damage to electrical equipment connected to the grid. At a high level, this means making sure electricity generation connects to the grid when demand goes up, and disconnects when demand drops. To help maintain this balance, and ensure the grid is stable and reliable, grid operators pay power providers for what are known as "ancillary services.”

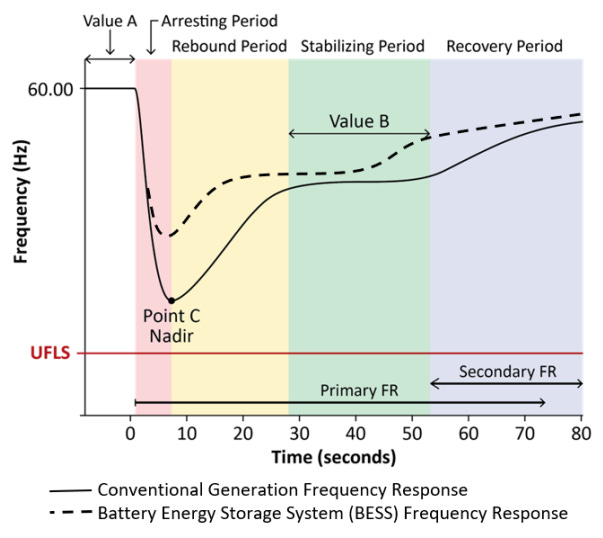

Some of these services are designed to maintain the frequency of the grid. The electrical grid uses alternating current, which means the electrons "slosh" back and forth along power lines at a certain rate (60 cycles per second, or Hz, in the US). If this rate rises too high or falls too low, problems occur and the grid may shut down: the recent large-scale blackout in the Iberian Peninsula was caused when grid frequency suddenly dropped from 50 Hz to 48 Hz.

Maintaining a given frequency requires power supplied and power demanded to match. If energy supplied to the grid falls (or if power demand rises), the frequency of the grid will fall. The sudden drop in frequency on the Iberian grid followed 2200 megawatts of generation getting disconnected. To maintain grid frequency, grid operators pay power providers to add power to the grid (“regulation up,” or regup) or remove power from the grid (“regulation down,” or regdown) to make constant, small adjustments to grid frequency.2

Regup and regdown services are used to provide minor frequency corrections to the grid, and require relatively small amounts of power. But grid operators also must have larger backup reserves in case of emergencies (such as a large power plant or transmission line suddenly getting disconnected from the grid). For this, grid operators require what’s known as “spinning” or “synchronized” reserves, sources of electricity generation that can be brought online very quickly, typically in less than 10 minutes. (Historically, these were called spinning reserves because they often consisted of a power plant that was already on — the turbine and generator were already spinning). There are also non-spinning or non-synchronized reserves: emergency sources of generation that take longer to come online. (These might still be conventional power plants with spinning turbines and generators, just ones that aren’t immediately able to provide power.)

Regulation up/down and spinning/non-spinning reserves are commonly purchased by most grid operators, but some operators also have markets for additional ancillary services. California’s CAISO, for instance, has a market for Flexible Ramping (generation sources that can come online if planned resources are unable to). Texas’ ERCOT has a more granular emergency reserves market, which in addition to spinning/non-spinning includes a market for Contingency Reserves to address potential forecasting errors.3

Batteries help balance supply and demand

Batteries are very good at supplying many of these grid stability services. A battery at a partial state of charge can either supply power to the grid (by discharging) or take power off the grid (by charging), making them extremely well-suited to providing regulation up and regulation down services. Batteries can also ramp up to full power extremely quickly (fractions of a second), making them excellent at providing “spinning” reserves (though of course there is no physical spinning at all). A recent North American Electrical Reliability Council (NERC) report noted that the use of battery storage systems may improve frequency control and response. And because batteries have lower marginal costs than other sources of power generation (no fuel, less maintenance), they can often supply these services for less cost than traditional sources of generation.

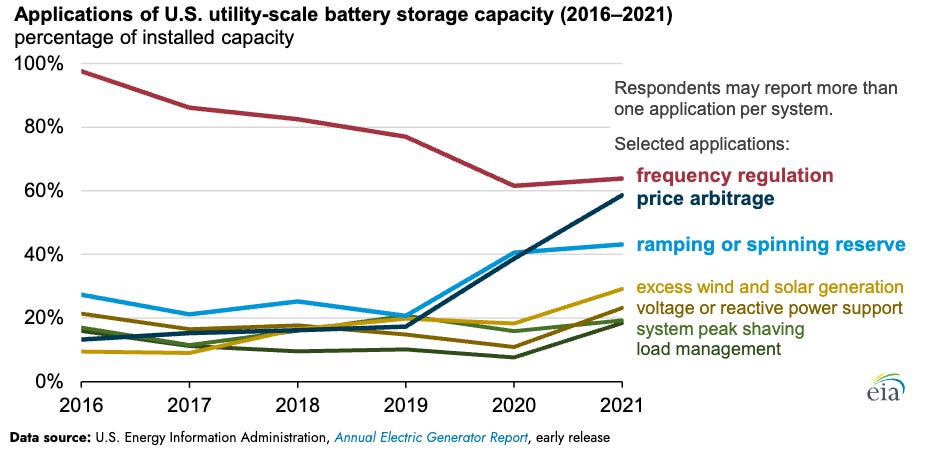

Because batteries excel at providing these services, and because providing them was often lucrative, ancillary services markets were an early driver of grid-scale battery adoption.4 PJM, the largest power grid operator in the US, became an early leader in battery storage installations after it created a market for fast-responding frequency regulation in 2012. By 2016, PJM had more battery power capacity than any other grid operator in the US, most of which was short-duration (45 minute) batteries built for the purpose frequency regulation.

Since 2016, PJM has been thoroughly eclipsed as the largest operator of battery storage by California’s CAISO and Texas’ ERCOT. In California, battery storage adoption has been driven by commitments to remove carbon-emitting sources of electricity generation. SB 100, passed in 2018, requires California to achieve 100% carbon-free electricity by 2045. An SB 100 report estimated that this will require on the order of 50 GW of battery storage. In Texas, by contrast, battery storage adoption has been accelerated by ERCOT’s electricity market. While many grid operators have what’s known as “capacity markets” (in essence, paying providers to provide power that might be needed), ERCOT operates an “energy only” market: generators are only paid for the power they provide. In the absence of capacity markets, the price for electricity in such a market can fluctuate much more, creating significant opportunities for battery storage operators to buy power when it's cheap and resell it when it's expensive.

For both California and Texas, the result has been an enormous increase in battery storage capacity. As of 2023 CAISO operates around 50% of the US’s 16 gigawatts of battery storage, and ERCOT operates just under 25%, compared to PJM’s 2.3%. As with PJM, early on much of this battery storage capacity was used to provide ancillary services. In 2020, over 80% of CAISO’s and 90% of ERCOT’s battery capacity was being used for regup, regdown, and spinning reserves. By 2023, roughly 2/3rds of regup and responsive reserve services in Texas were being provided by battery storage, and in 2023 batteries provided 63% of CAISO’s regdown and 80% of its regup.

Batteries and peak shaving

Ancillary services are key for keeping the grid reliable, but many of them require a relatively small amount of power. Battery capacity has grown to such an extent in CAISO and ERCOT that it now greatly exceeds what’s needed to provide ancillary services. The 63% and 80% of regdown and regup services provided by batteries in California in 2023, for instance, were provided by just 16% and 8% of California’s 8 GW of battery storage capacity.5

Rather than provide these sorts of services, batteries in California and Texas are increasingly being used for energy arbitrage: buying power when it’s cheap (such as the middle of a sunny day when output from solar panels is high), and selling it when it’s expensive (such as the evening when demand rises and output from solar panels falls). In ERCOT for instance, in 2023 only 15% of battery revenues came from energy arbitrage; by 2024 that had risen to 60%.

This energy arbitrage allows grids to make use of excess solar or wind energy that would otherwise simply be wasted (known as “curtailment”). But it also makes energy grids more reliable. By storing excess power, batteries can help supply power during periods of peak demand, reducing the overall burden on other sources of generation (as well as transmission lines, if batteries are built near sources of load) and reducing the risk that demand may exceed supply.

In Texas, the increase in battery storage has been credited with helping reduce the risk for summer power outages. In 2023, Texas’ ERCOT issued 11 conservation calls (requests for consumers to reduce their use of electricity), including 7 during late August, to avoid reliability problems amidst high summer temperatures. But in 2024 it issued no conservation calls during the summer. In part this was due to the rapid increase in battery storage, which rose by 4 gigawatts (roughly 50%) between January and June 2024. Not only did batteries help prevent capacity issues, but they also helped reduce electricity prices during peak hours, and are credited with contributing towards more than $750 million in electricity cost savings for Texas consumers over this period. This coming August, ERCOT is forecasting a 0.5% risk of having to declare an emergency energy alert (EEA), down from a 16% risk in 2024. In part this is because demand is forecasted to be lower this August than last August, but it’s also because of an increase in battery storage capacity (whose expected contribution in the highest-risk hours rose by a factor of 5 between 2024 and 2025). Battery storage has also been credited with helping to avoid any conservation calls during a recent May heatwave in Texas:

“A few short years ago, a heat wave… could have led to conservation requests and risked rolling blackouts or power outages across Texas,” said Daniel Giese, Texas director of the Solar Energy Industries Association. “But times have changed for the better.”

The grid of 2025 has tools the system of 2022 did not: An influx of solar generation and battery storage that ERCOT could use to keep up with demand even though a number of natural gas- and coal-fired power plants were on maintenance and repair breaks typical for May.

At its peak, battery storage provided 4.17 GW (over 6% of ERCOT’s total demand) to Texans during the May heatwave, nearly as much as was provided by nuclear power. This is up from 2.5 GW (4.2%) two weeks prior to the heatwave, and 1 GW (1.6%) at the same time the previous year.

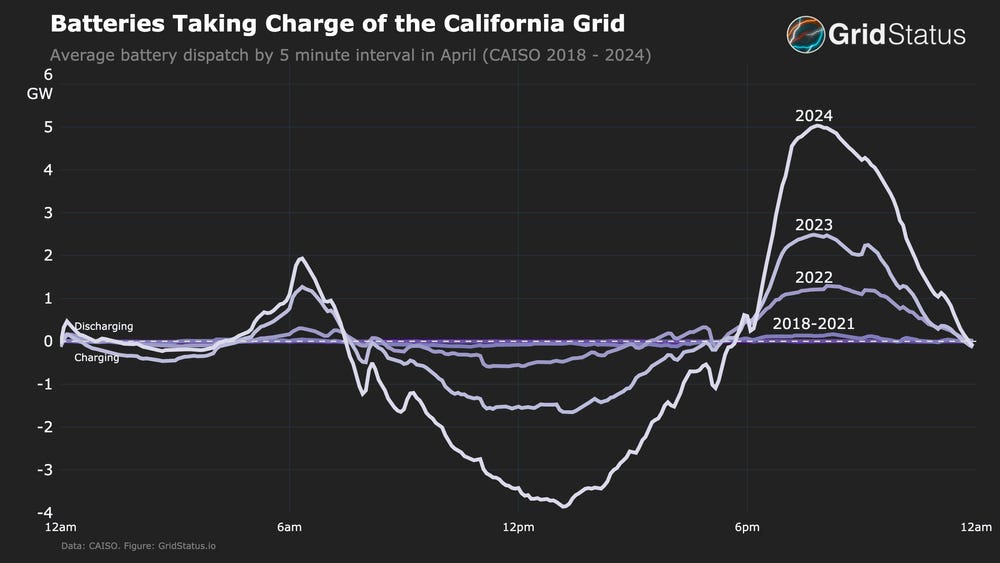

In California, large-scale deployment of battery storage has similarly been credited for helping the state meet demand during heatwaves. Between 2022 and 2024 peak power output of battery storage in the evening hours rose by roughly a factor of 4, from just over 1 GW to 5 GW. Batteries are now responsible for serving over 30% of California’s power demand for brief periods during evening hours.

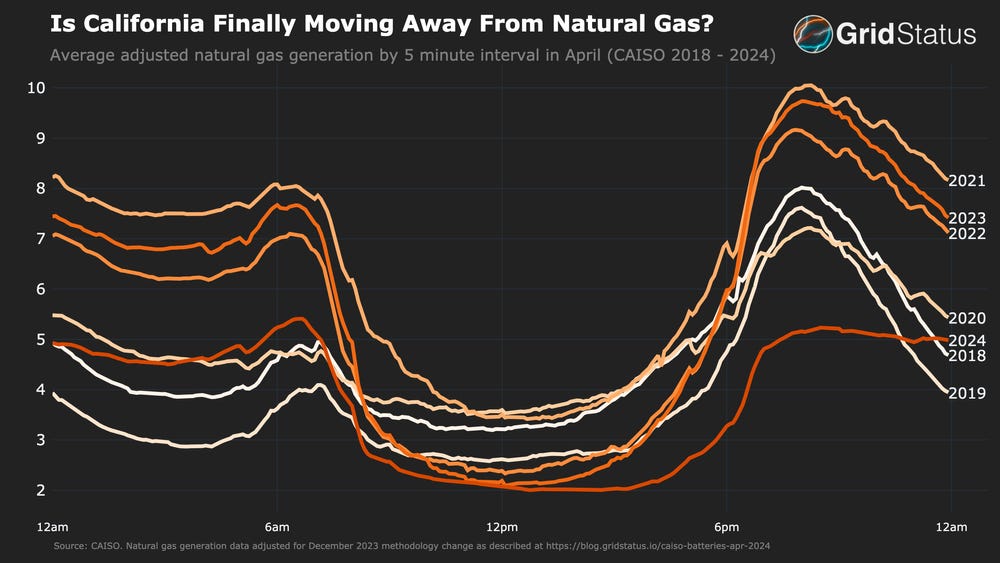

Prior to California’s large-scale battery storage deployment, generation from natural gas power plants spiked in the early evenings as output from solar PV declined. But thanks to battery storage, power output from natural gas in the evening hours declined by roughly 50% between 2021 and 2024. This has reduced the amount of natural gas capacity that needs to be kept online during the day.

You can see the progression of battery use in California by looking at snapshots of their daily output. On June 1st 2019, battery storage output rapidly shifts back and forth, going from positive to negative as it helps regulate the grid frequency. Maximum discharge is less than 200 megawatts, and net contribution to meeting power demand is essentially zero.

On June 1st 2022, batteries are beginning to be used more for meeting load (peaking at around 4.5% of overall demand); the rapid charging and discharging to help regulate frequencies is now superimposed on a trend of negative load during the day (when batteries are charging) and positive load in the evenings. Discharge peak has risen from less than 0.2 GW to nearly 1.5 GW.

On June 1st 2025, this pattern is even more pronounced. Discharge peaks are even higher, over 6GW, and the overall shape of the charge/discharge pattern is much smoother. While in 2019 batteries were rapidly alternating between charging and discharging to help maintain frequency, now this variation is a small disturbance on an otherwise smooth pattern of charging during the day and discharging at night.

Batteries and grid-forming

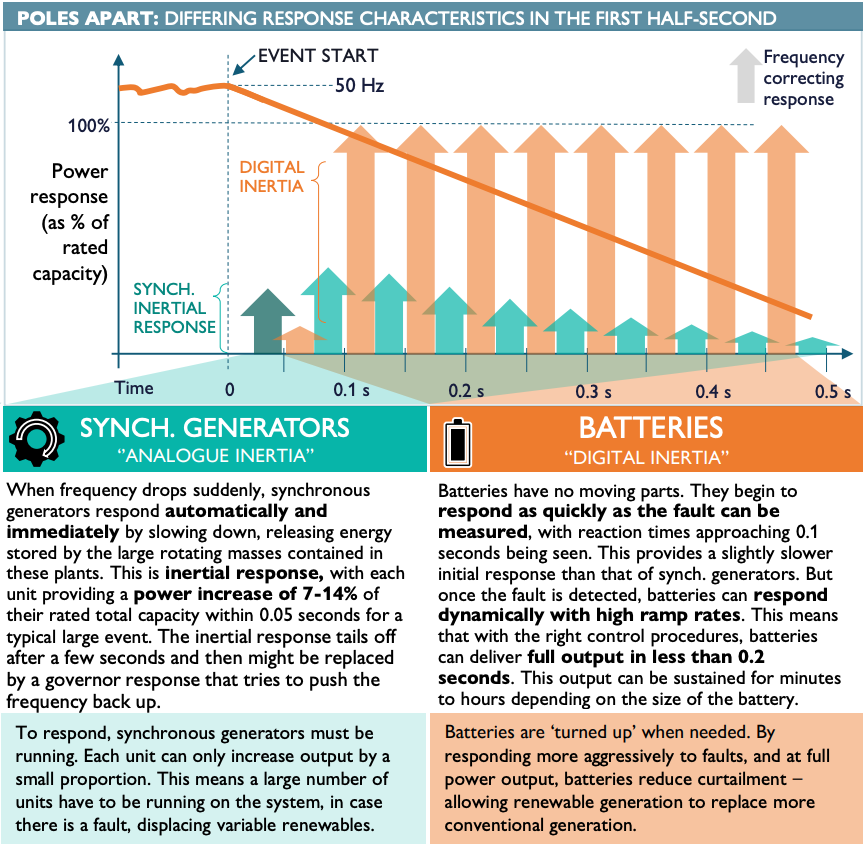

Batteries, solar panels, and wind turbines are all “inverter-based resources” (IBRs): while power plants that spin a generator generate alternating current directly, IBRs generate direct current and convert it to alternating current using an inverter. Historically, these inverters have been what’s known as “grid following”: they require some other source of power, generally a large spinning generator, to establish an alternating current frequency, and then match that frequency. If frequency on the grid unexpectedly declines sharply (due to things like a transmission line or power plant suddenly getting disconnected), spinning generators will resist this change due to inertia effects: the heavy spinning generators will automatically and mechanically slow down, dumping a portion of their rotational energy into the grid. This counteracts the sudden drop in frequency and makes the grid more robust to sudden unexpected frequency disruptions.

Critically, grid-following inverter-based resources don’t have the capability of automatically stabilizing the grid via inertia effects. This has created concerns that large-scale deployment of inverter-based resources, and removing sources of inertia from the grid, will result in grid instabilities and power system failures. The recent Iberian Peninsula blackout has been blamed on having too many inverter-based resources (over 70% at the time of the blackout) and insufficient generation with inertia to counteract grid instabilities.

However, inverters, particularly battery inverters, can also be designed to be “grid forming,” capable of establishing a reference frequency.6 Grid-forming inverters can counteract grid instabilities via what’s known as “synthetic inertia”: detecting sudden drops in frequency, and rapidly ramping up their power to counteract them. In fact, because of how batteries function, they can supply much more of this equivalent inertia than spinning generators. The inertia response of a spinning generator is a small fraction of its total capacity, and declines quickly. Batteries can supply 100% of their capacity as inertia response, and do so until they run out of charge. The inertia response provided by 1000 megawatts of spinning generation could be provided by just 120 megawatts of batteries.

Batteries with grid-forming inverters are relatively new, but are becoming more common. In the US, several batteries with grid-forming inverters have been installed in Hawaii, and US grid operators are working to standardize their requirements. They have also been installed in Ireland, Australia, Germany, and the UK. Grid-forming inverters will allow for very large levels of wind and solar penetration while maintaining grid stability: Ireland has achieved up to 75% of renewable generation in part by using grid-forming inverters and synthetic inertia. If properly designed, grid-forming inverters also let batteries provide other critical grid functions, such as black start (starting a grid from a state of zero power).

Conclusion

Thanks to their ability to rapidly charge and discharge, and to store electricity for when it’s most needed, batteries are becoming an important tool for making electrical grids reliable. While today grid-scale battery storage capacity is still small in absolute terms (energy storage supplied by batteries is about 43 gigawatt hours, less than 1/10th the energy storage capacity of pumped hydro plants in the US, and less than 1/100,000th the energy storage capacity for petroleum), in the absence of any sort of disruption, we can expect the values for battery storage to grow rapidly. Battery projects (either alone or paired with a source of generation) make up nearly half of planned electricity generation projects by capacity. There are 394 gigawatts of battery-only projects in the interconnection queue, or 25 times existing battery capacity on the grid. If it maintains its faster-than-Moore’s-Law current rate of growth (doubling about every 15 months), battery storage energy capacity will surpass pumped hydro as the largest source of grid-scale electrical storage around 2029. This will allow greater use of wind and solar resources, and help ensure grid reliability across the entire US. As batteries continue to be installed in greater numbers and the technology advances, we should expect them to take a larger and larger role in making our grid more reliable.

Though limited energy capacity means that batteries could only supply that power for a few hours

Sometimes these are just called “regulation services.”

Though ERCOT calls it Rapid Reserve Service, not spinning reserves.

An example of how lucrative ancillary services can be: in 2023 regup and regdown made up roughly 2/3rds of battery storage revenues in CAISO, despite only a small percentage of battery storage being used for these services

Battery storage power capacity at the end of 2023

IBRs can also provide inertia by adding synchronous condensers (large rotating motors with no load), but batteries will likely be much less expensive to deploy.

Batteries are a promising fix to electrical sustainability. I have a question about generation.

If the problem is gas/coal/solar/wind generation, why isn't Nuclear being thrown in the mix?

Nuclear provides more power, cheaper, and it's easy to maintain, especially the new salt and boron reactors.

Why is the interconnection queue so long?